The Big Picture

We’re heading into 2021 with both new momentum for bold climate action, and jarring reminders that winning climate justice depends on defeating fascist, white supremacist movements rearing up to protect an unjust status quo.

First, the momentum. In December, on the heels of the release of the 2020 Production Gap Report, Denmark took decisive action to phase out its oil and gas production. The government reached a broad political agreement to cancel its ongoing 8th licensing round, ban all future oil and gas licensing, and set a final phase-out date of 2050 for all fossil fuel extraction. This came as a result of years of advocacy from civil society and social movements in Denmark, Europe, and beyond, and includes commitments to ensure a just transition for workers. Given Denmark’s status as the EU’s largest oil producer and one of the world’s wealthiest producers, campaigners in Denmark will keep pushing for an accelerated phase-out date.

Denmark said its goal is to inspire other producers to follow its lead. More than 500 groups in the United States are already urging the incoming Biden administration to do so, by banning new federal fossil fuel leasing and permitting.

Last week’s election results in the U.S. state of Georgia, in which climate activists played a key role, opened up further political space for action. For the first time in a decade, a party committed to addressing the climate crisis will control both the federal executive and legislative branches of the world’s largest oil and gas producer – and advocates will be hard at work pushing for a phase-out of fossil fuels.

But reversing the fossil fuel cronyism of the Trump era will require rebuilding U.S. democracy and fighting for racial and economic justice. The violent coup attempt by white supremacists in the U.S. Capitol last week was far from unprecedented, but nonetheless shocking. It’s clear that winning policies to wind down the fossil fuel era will require shifting power away from elites who exploit and fuel racism – and to peoples movements fighting for justice. We must ensure that the voices and votes of Black, Brown, Indigenous, and other structurally oppressed peoples are heard and protected in the face of reactionary movements in the U.S. and across the globe that would destroy democracy to defend their power, wealth, and privilege.

–The OilWire Team

The Data

While the ongoing COVID-19 crisis led to declines in oil, gas, and coal production in 2020, governments are still planning to produce far more fossil fuels by 2030 than is consistent with limiting warming to 1.5ºC or 2ºC. Yet, COVID-19 stimulus packages so far commit far more public money to fossil fuels than clean energy.

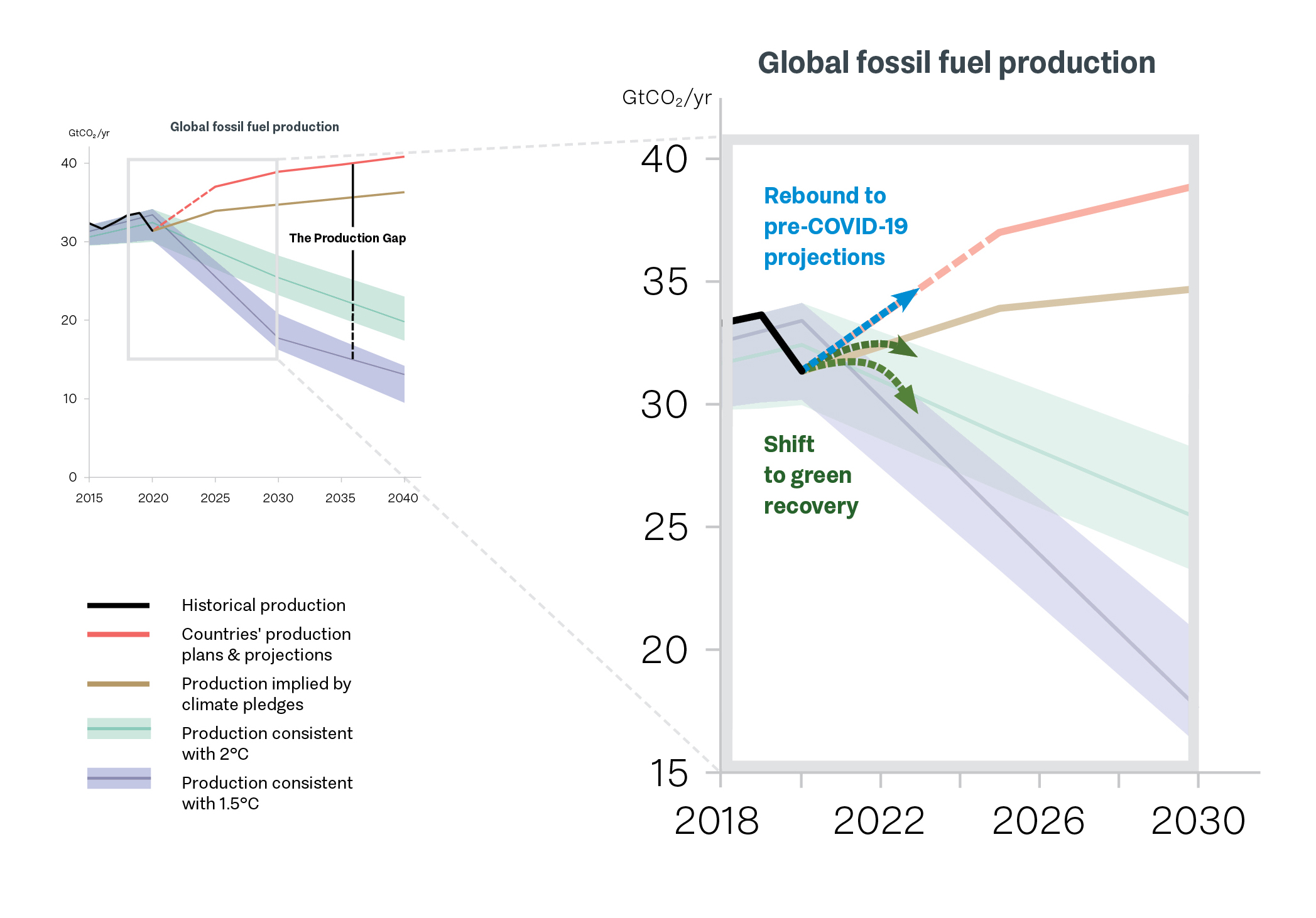

This is the stark warning delivered last month in the 2020 Production Gap Report, released by the Stockholm Environment Institute, UNEP, and other leading research organisations. While the world needs to decrease fossil fuel production by 6% per year this decade to get on a 1.5ºC-consistent pathway, countries are currently planning and projecting a 2% annual increase, as highlighted in the figure below.

The fossil fuel production gap: National production plans vs. 1.5ºC and 2ºC pathways

Source: SEI, IISD, ODI, E3G, and UNEP. The Production Gap Report: 2020 Special Report.

What We’re Tracking

Trends in the right direction

UK to stop financing overseas oil and gas projects

In December, UK Prime Minister Boris Johnson announced that the country would end financing for overseas fossil energy projects at some time in 2021. This is very significant: the UK is the first major economy to implement a policy like this and over the last five years UK support for overseas fossil energy projects totalled at least GBP 3.5 billion. The government has said there will be “limited exceptions” to this new exclusion, but the details will only be announced after a consultation this February. After getting the details right, the COP26 host should turn its attention to ensuring other governments follow suit with similar commitments.

IEA to publish special report with full 1.5ºC-aligned net zero scenario

This week, the IEA announced that it will publish a special report, The World’s Roadmap to Net Zero, on 18 May 2021. This report will be the first IEA analysis to contain a fully-fledged 1.5°C scenario for the energy system. This is a long overdue and urgent first step towards providing governments with the right tools to meet the Paris Agreement goals, and comes at the request of the COP26 presidency. IEA head Dr. Fatih Birol further explained the announcement in a Financial Times op-ed. What is critical, however, is that this new scenario becomes the cornerstone of the IEA’s flagship World Energy Outlook, a key guide for governments and investors.

Little interest in Arctic drilling in Alaska

Though the Trump administration has rushed to sell drilling leases within the Arctic National Wildlife Reserve in the final weeks before Trump leaves office, very few buyers turned up. Companies considering this disastrous drilling – which would need to be undertaken against the wishes of Native Alaskans, 70% of U.S. voters, and many major shareholder and investor groups – struggled to secure finance. Ultimately, only two small companies joined the State of Alaska in the bidding. Half of the offered leases received no bids.

Momentum for fracked gas import ban builds in Ireland

Last year, the incoming Irish government pledged to put a complete ban on new licensing for oil and gas exploration, after the previous government banned only oil licensing. The new Irish climate policy went further, proposing the world’s first ban on importing fracked gas. This import ban has gained new momentum over the past few months. In November, a legal opinion confirmed that including this ban in Ireland’s Climate Bill would be compatible with EU trade laws. In December, the parliament’s Joint Committee on Climate Action recommended that the bill be strengthened with “a comprehensive plan to ban the importation of fracked gas and specifically to ban LNG terminals in Ireland within the year 2021.” Yesterday, news broke that the Port of Cork has declined to renew a previous contract to import gas from an LNG facility under development in Texas, which likely spells the end of LNG import plans in Cork.

Campaign news

Costa Rica and Denmark urge other countries to set oil and gas production end date

Denmark’s Minister of Climate and Energy and Public Utilities, Dan Jørgensen, and Costa Rica’s Climate Change Director, Andrea Meza Murillo, together penned an op-ed in Climate Home News in December, urging countries to stop expanding fossil fuel extraction and set an end date for production. They argue:

Addressing the growing gap between fossil fuel production and our climate targets requires a redefinition of what it means to be a climate leader. With the 1.5C target only just visible in the distance, we need to cut with both hands of the scissors, addressing demand and supply simultaneously.

We must continue to reduce demand for fossil fuels but at the same time, we need to put an end to fossil fuel exploration and establish final cutoff dates for production that are consistent with the imperative of climate neutrality. Fossil fuel companies that understand and act on the urgency of the climate crisis are invited to play their part.

Wealthy, diversified, fossil fuel producing countries must act fast and first in proving that a just transition and a phase-out of oil and gas production is not only possible, but responsible.

Campaign launched to separate creative industries from fossils

A group of media strategists, creatives, and industry leaders have launched a new campaign called Clean Creatives. It includes a pledge for creatives to decline contracts with fossil fuel companies, associations, and front groups – and for clients to decline to work with agencies or creatives that work with the fossil fuel industry. This is particularly significant because the fossil fuel industry spends more than USD 200 million per year on corporate promotion and trade associations.

Investors push five major U.S. banks on climate action

In late 2020, a group of shareholder advocates and investors filed climate resolutions with JPMorgan Chase, Wells Fargo, Bank of America, Goldman Sachs, Citigroup, and other smaller U.S. banks. These resolutions request that the banks address whether, when, and how they will measure and disclose the greenhouse gas footprint of their financing.

Cities in U.S. and Europe consider endorsing Fossil Fuel Non-Proliferation Treaty

In November and December, several cities – including New York, Los Angeles, and Barcelona – introduced resolutions or held council debates considering whether to endorse the idea of a Fossil Fuel Non-Proliferation Treaty. Vancouver has already endorsed it. Veteran journalist Jacques Leslie has written a Los Angeles Times op-ed urging the city to add its support.

Fossil gas for transport: ‘A dead end’

Laura Buffet of Transport & Environment outlines the “dodgy tactic” and “dubious offsets” being used by oil giants like Total to promote fossil gas for transportation – and, in particular, debunks industry arguments for investment in fossil gas transport infrastructure.

More headlines

Norwegian Supreme Court approves oil exploration – but not production?

On 22 December 2020, Norway’s Supreme Court upheld the government’s 2011 and 2013 Arctic oil exploration grants. This marked the end of four years of litigation brought by Greenpeace Nordic, Nature and Youth, and others. The Court found that the country’s constitution protects citizens from environmental harms, including those from burning exported oil, but found that the future emissions from oil exploration were too uncertain to bar the granting of those licenses. Critically, however, the Court noted that these emissions and harms would have “great weight” in future oil production decisions. The Center for International Environmental Law notes that this dramatically increases the stranded asset risks faced by companies exploring for oil in Norway.

Giant new carbon bomb in the Kavango Basin?

Oil experts involved in turning Texas into the world’s epicenter of fracking are now saying the Kavango Basin in Namibia and Bostwana could be the “largest oil play of the decade,” comparable in geology and scale to the U.S. Permian Basin. In late December, Canadian-based company Recon Africa began exploratory drilling in northeastern Namibia, raising alarm with community groups and campaigners. They warn that a new fossil extraction boom in the Kavango Basin would have disastrous consequences for both the climate and people’s human rights. An oil boom there could threaten water supplies for thousands of people and endangered wildlife, including in the Okavango Delta, a UNESCO World Heritage site.

U.S. Federal Reserve ‘Main Street’ lending dominated by fossil fuels

According to analysis by BailoutWatch, oil and gas companies in November further solidified their position as the top beneficiaries of the U.S. Federal Reserve’s COVID-19 “Main Street” lending program. In updated figures, these companies received more outsized loans of tens of millions of dollars than any other sector, even as clean energy companies’ small share of the program’s benefits dwindled.

Industry news

More big oil and gas companies set misleading net zero targets

Under pressure from people, investors, and others, eleven of the 30 biggest oil and gas companies have now set some form of net zero target. However, many of these targets continue to exclude the largest portion of climate pollution from oil and gas: Scope 3 emissions, which includes the emissions from burning extracted oil and gas.

What these companies lack in ambition, they make up for in obfuscation – as outlined in the briefing Big Oil Reality Check. As noted in November’s OilWire, a recent report shows the “net” in “net zero” greenwashes weak climate targets.

ExxonMobil discloses the emissions from burning its oil and gas

For the first time, ExxonMobil has disclosed its Scope 3 emissions data, revealing that the emissions from the petroleum products it sells amount to 730 million metric tonnes – or about as much as Canada’s total emissions. The company, however, still does not provide any forecasts of its future emissions and has no targets to reduce this carbon pollution. Instead, it uses scenarios from the International Energy Agency that are inconsistent with limiting warming to 1.5ºC to justify further unsustainable investments in oil and gas production.

Reuters: Oil majors hide billions in tax havens

A new special report from Reuters outlines how big oil and gas companies hide away huge profits in tax havens (even while also receiving government support in other jurisdictions). For example, Shell reported more than USD 2.7 billion in tax-free revenue (about 7% of their total income) in entities registered in Bermuda and the Bahamas. BP’s “captive insurer,” Jupiter Insurance Ltd (which only provides insurance to other BP companies), accounts for 14% of BP’s global annual profits. Jupiter outsources its administration tax free to a brokerage based in Guernsey, a UK Channel Island with no tax on corporate profits.

Resources

New scorecard: How leading insurers stack up on fossil fuels and climate

The Insure Our Future campaign has released a new scorecard on major insurers’ and reinsurers’ policies on insuring and investing in oil, gas, and coal, as well as other aspects of climate leadership.

New Observatorio Petrolero Sur report: Just Transition in Latin America

This report highlights the need to establish specific pathways towards a Just Transition in the Global South, and how this must be different from the concept’s application in the Global North. Labour, union, social, and Indigenous movements all have a critical role to play.

Five Years Lost: How finance is blowing the Paris carbon budget

Ahead of the 5th anniversary of the Paris Agreement, 18 NGOs released a joint report showing that 12 fossil fuel projects currently planned or under development would alone exhaust three-quarters of the remaining carbon budget for limiting global warming to 1.5ºC (with a 66% probability). The report identifies the banks and investors funding these 12 projects, and shows the environmental damage, violation of Indigenous rights, negative health impacts, and human rights concerns associated with each – as well as the carbon pollution.

Are banks’ 2050 pledges enough to reign in fossil fuel finance?

In a recent blog from BankTrack, researchers delve into whether or not existing climate pledges from big banks align with the 1.5ºC target established by the Paris Climate Agreement. For example, JPMorgan Chase funds fossil fuels to the tune of roughly USD 65 billion per year, but committed to aligning its finance with the Paris Agreement. Analysis from BankTrack revealed that a majority of these pledges lacked detail on how to reach targets by 2030, which would require immediate steps to phase out fossil fuel finance.

Carbon Tracker analysis: Oil and gas companies’ remuneration policies

This new analysis, Groundhog Pay, identifies how oil and gas companies’ remuneration policies drive climate pollution. Ninety percent of companies studied directly reward executives for fossil production or reserves increases – even where those companies have claimed net zero ambitions.

Above and Beyond Carbon Offsetting: Alternatives to compensation for climate action and sustainable development

A report released by Carbon Market Watch makes the case that relying on carbon offsets to meet climate targets is risky and unsustainable.

FERC gives blank check approval to pipeline builders, while investors and consumers pick up costs

A briefing note released by the Institute for Energy Economics and Financial Analysis finds that the primary agency responsible for approving U.S. interstate gas pipeline projects, the Federal Energy Regulatory Commission (FERC), has been basing its pipeline decisions solely on the existence of contracts, rather than economic or public interest. Three major pipeline projects FERC previously approved ended up being canceled by companies in 2020 after years of grassroots resistance.