The Big Picture

Following a wave of youth-led protests, rising citizen concern, and mounting climate destruction, several governments have recently declared a “climate emergency” or proposed new goals for reducing pollution. However, many of these same governments – Canada, the UK, and Ireland being prime examples – are acting at cross-purposes to their commitments.

The carbon math shows that existing extraction projects globally contain more oil and gas than we can afford to burn to keep global heating below 1.5°C. This means that governments must choose: Are they for the Paris Agreement or fossil fuel expansion?

While a growing list of leaders is getting this message, others are slow to catch up. The day after declaring a climate emergency in Canada, Prime Minister Justin Trudeau gave the okay to a massive tar sands pipeline expansion fiercely resisted by First Nations. The UK was the first country to declare a climate emergency, but a month later awarded 37 offshore drilling licenses, and continues to spend billions on fossil fuel finance and subsidies. Shortly after also declaring a climate emergency, Ireland’s ruling party used legislative tricks to “sabotage” a ban on new oil and gas exploration.

As Greta Thunberg says, “The fossil fuels must stay in the ground.” Climate leadership requires acting to stop new fossil fuel development. And, as new analysis featured below also shows, gas is no exception to this rule.

–The OilWire Team

The Data

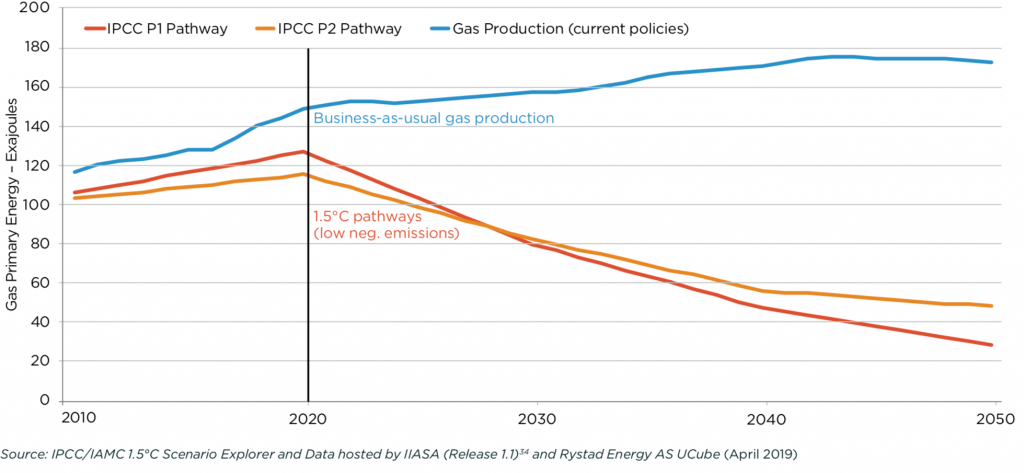

The figure below, from the new report Burning the Gas ‘Bridge Fuel’ Myth, compares a business-as-usual projection of global gas production with demand pathways aligned with limiting global warming to 1.5°C. The 1.5°C pathways shown below are the two illustrative pathways from the Intergovernmental Panel on Climate Change (IPCC) special report with the least reliance on unproven negative emissions technologies.

The oil and gas industry’s plans to continue increasing extraction, locking in carbon emissions for decades into the future, run counter to global climate goals. In both 1.5°C-consistent pathways, gas consumption falls by 3 to 5 percent per year on average between 2020 and 2050.

Global Gas Pathways: Business-as-usual extraction vs. demand aligned with 1.5°C

Source: Lorne Stockman, Burning the Gas ‘Bridge Fuel’ Myth: Why Gas Is Not Clean, Cheap, or Necessary, Oil Change International, May 2019.

What We’re Tracking

Trends in the Right Direction

Indigenous resistance in Ecuador halts more oil expansion plans

Indigenous peoples in the Amazon region of Ecuador continue to beat back oil expansion in their territories, following a historic legal victory in April. Last month, more than 1,500 people shut down 36 oil wells on Kichwa territory and blocked a major highway, demanding no new expansion and the clean-up of existing contamination. After five days of protest, the Ecuador government agreed for the first time to stop expansion of an already-producing field. Also in May, the government delayed the licensing of two new oil blocks near the border with Peru, where Indigenous communities have vowed to halt oil development.

UK Parliament calls for an end to overseas fossil fuel finance

The UK Parliament’s Environmental Audit Committee released a report this month calling on the government to phase out all overseas finance to fossil fuels within two years. The committee’s inquiry condemned the fact that 96 percent of UK Export Finance went to fossil fuels over the past five years, locking poorer nations into high-carbon infrastructure and contradicting the UK’s climate goals. The inquiry included testimony and written evidence from the Overseas Development Institute, Global Witness, Oil Change International, Platform, and other civil society experts. Committee Chair Mary Creagh urged, “It is time for the government to put its money where its mouth is and end UK Export Finance’s support for fossil fuels.” The editorial board of the Financial Times quickly endorsed this call. Read the committee’s report.

Insights

European Investment Bank’s fossil gas funding clashes with Paris goals

The world’s largest multilateral lender, the European Investment Bank (EIB), is facing growing pressure to rule out further fossil fuel finance and align its energy lending policy with the Paris Agreement as it goes under review. New analysis by Oil Change International shows that 72 percent of investment costs associated with EU Projects of Common Interest are directly tied to fossil gas expansion, even though none of the European Union’s future energy scenarios anticipate an expanded role for gaseous energy carriers. EIB directed EUR 2.5 billion towards fossil fuels in 2018, driven by its largest-ever loan to a major gas pipeline project.

Analysis: More gas is a ‘bridge’ to climate disaster

“It’s now clear that if the world is to meet the climate targets it promised in Paris, natural gas, like coal, must be deliberately and rapidly phased out,” writes David Roberts at Vox, while noting that many policymakers have yet to catch up on this consensus. Read Roberts’ summary of five reasons that “gas is not, and can not be, a bridge to a cleaner energy system,” based on recent Oil Change International analysis.

Campaign News

Canadian government approves TMX pipeline after declaring ‘climate emergency’

The Trudeau government approved the Trans Mountain pipeline expansion project (TMX) this Tuesday after ten months of extra review and consultation ordered by Canada’s Federal Court of Appeal – and less than 24 hours after it declared a “climate emergency.” Leaders of Coast Salish Nations slammed the government for its conflict of interest as both owners and regulators of the pipeline. Analysis shows the Trans Mountain pipeline expansion would facilitate expanded tar sands extraction – causing as much as 130 million additional metric tons of carbon pollution per year. Leaders of the Tsleil-Waututh and Squamish First Nations and the mayor of Vancouver plan to mount further legal challenges to the project, which has been held up for four years. First Nations launched a new online hub for organizing resistance: stoptransmountainpipeline.org.

Resistance continues to stall Enbridge tar sands pipeline

While Prime Minister Trudeau approved expansion of the Trans Mountain tar sands pipeline again this week, the ongoing campaign to stop that project and other export pipelines continues to constrain oil expansion in Canada. A recent court ruling in Minnesota means more delay for Enbridge’s Line 3 pipeline, with additional lawsuits against that project still pending. Meanwhile, Michigan’s attorney general has threatened to shut down Enbridge’s deteriorating Line 5 pipeline that runs under Lake Michigan over spill risks, warning “our state is in great peril every single day” it keeps operating.

Irish government faces protests over ‘sabotage’ of oil and gas licensing ban

Members of the Irish parliament and citizens are protesting what they call the Irish government’s “sabotaging” and “undemocratic” delay of legislation that would ban new licenses for oil and gas extraction in the country. The so-called Climate Emergency bill has passed through two stages in the Irish parliament and was due to move to the next in mid-June. However, Ireland’s ruling party, which opposes the bill, threw up another roadblock – using a procedural trick that means the government must approve a “money message” for the bill before it can move further. Bill Sponsor Brid Smith TD said, “The government has shown itself to be merely concerned with climate PR and greenwashing rather than taking radical and affirmative action on the ever more urgent climate crisis.”

Greenpeace blocks BP oil rig en route to North Sea

Activists with Greenpeace have taken to sea to prevent a BP oil rig from reaching its drilling destination in the North Sea, a standoff that has lasted ten days and reportedly cost BP more than GBP 1.5 million. Sarah North, an activist aboard the Greenpeace ship, said, “There’s only one U-turn BP urgently needs to make and that’s away from climate-wrecking oil and towards renewable energy.” While the UK has pledged to phase out coal, its government continues to maximise oil and gas extraction, increasing subsidies and issuing new licenses.

Activists from across Europe occupy the EIB

As noted above in the “Insights” section, the EIB is facing growing public pressure to stop financing new fossil fuel infrastructure – and bank leaders are beginning to respond. In recent weeks, protesters from across Europe occupied the entrance outside EIB headquarters, sharing stories of resistance to fossil fuel projects the bank is funding. Ahead of last week’s meeting of EU Finance Ministers, Counter Balance also issued a letter from more than 70 organisations and academics across Europe calling on EIB to “stop pouring fuel on the fire” of climate crisis and go fossil free. After the meeting, EIB President Werner Hoyer set high expectations for reform, declaring that, “The EIB is Europe’s climate bank.”

New U.S. party consensus? Stop fossil fuel finance, no drilling on public lands

Among the many contenders for the Democratic Party nomination for U.S. president, a growing number are aligning around long standing climate movement demands to phase out federal support for fossil fuels. In addition to support for a Green New Deal, policies to ban oil, gas, and coal drilling on federally controlled public lands, as well as to end public finance for fossil fuel projects are gaining prominence as part of the standard for climate leadership.

More Headlines

As Mozambique is shorted on recovery money, Anadarko approves USD 20 billion LNG project

Mozambique has received pledges for less than half of the estimated USD 3.2 billion it needs to rebuild from two devastating cyclones fueled by global warming. But investment is coming to develop the “largest single LNG project approved in Africa,” a project that will worsen the climate crisis. This week Anadarko announced its final investment decision to construct a USD 20 billion gas liquefaction and export terminal in the Cabo Delgado province of Mozambique – the same region hit by Cyclone Kenneth in April. Gas development in the area has already caused the forceful displacement of local residents and conflict.

Banks petitioned to halt finance for controversial Uganda oil pipeline

More than 30 local and international organisations are calling on South Africa’s Standard Bank Group and Japan’s Sumitomo Mitsui Banking Corporation to stop arranging finance for a Ugandan oil pipeline project that threatens livelihoods, water resources, and the climate. The USD 3.5 billion, 1,445 kilometer pipeline would enable exports via the port of Tanga in Tanzania from fields in western Uganda that are estimated to hold six billion barrels of oil, controlled by Total, CNOOC, and Tullow Oil. The NGOs’ letter warns that the project would bring “unacceptable risks to local people through physical displacement and threats to incomes and livelihoods” on top of its environmental threats.

Netherlands speeds up Groningen gas phase-out after latest earthquake

The Dutch government confirmed this week that it is considering accelerating a planned production phase-out at the country’s largest gas field in response to continuing earthquake damage. After a 3.4 magnitude earthquake last month, the Dutch gas regulator recommended limiting extraction at the Groningen field, operated by ExxonMobil and Shell, to 12 billion cubic meters next year. This would represent a 20 percent drop from the cap previously announced for next year. The government has pledged to phase out all production at Groningen by 2030.

Industry News

While expanding oil and gas, Shell CEO punts blame to consumers

During a London speech, Shell CEO Ben van Beurden pointed to people “who choose to eat strawberries in winter” and inadequate recycling as drivers of climate crisis. Notably, van Beurden did not mention Shell’s plans to invest nearly USD 150 billion dollars into expanded oil and gas extraction over the next decade as counter to climate action. Shell is currently being sued in the Netherlands for failure to align its business model with the Paris Agreement goals.

Total touts ‘supercomputer’ to speed up oil exploration

Even as analysis shows new oil exploration is incompatible with the Paris goals, French oil major Total is touting a new “supercomputer” to help it explore for new oil faster and in more difficult offshore environments. According to Reuters, “Total did not say how much it had invested in the new supercomputer.”

After guilty plea, Husky fined CAD 3.8 million for devastating oil spill

In 2016, a Husky pipeline spewed oil into the North Saskatchewan River in Canada, killing wildlife, polluting traditional fishing areas, and shutting off drinking water for thousands of people. In a court deal this month, Crown prosecutors dropped seven of ten charges, with Husky pleading guilty to three and getting off with a CAD 3.8 million fine. Spill victims, including First Nations and impacted towns, say Husky’s response has been inadequate. “We no longer fish in the river … [or] … drink water drawn from reserve lands,” said Chief Wayne Semaganis of the Little Pine First Nation.

Resources

The Fracking Endgame

A new report from Food and Water Watch examines the link between fracking expansion and three types of industrial build-out required to keep it going: petrochemical manufacturing, gas exports, and gas-fired power plants.

OECD Update: Fossil fuel subsidies on the rise again

A new OECD-IEA report prepared for the G20 finds that subsidies and support for fossil fuel production and use are rising again globally. The update notes that the oil and gas industry in particular continues to benefit from “tax provisions that provide preferential treatment for cost recovery” and “go against domestic efforts to reduce emissions.”

Renewables 2019 Global Status Report

The latest report from REN21 shows that renewable energy is increasingly cost-competitive and growing its share of global electricity capacity additions. However, simultaneous growth in fossil fuel use is holding the sector back, especially in heating and transport. The report warns that, “low fossil fuel prices encourage further demand for fossil fuels and challenge renewable energy markets.” Expanded oil and gas extraction is a driver of lower prices.