The Big Picture

As uprisings against racial and colonial violence continue to sweep the world, activists and land protectors won major victories this week against three U.S. pipeline projects, each of which depended on environmental racism and exploitation of stolen land.

These victories demonstrate once again that when we fight, we win – especially when we follow the leadership of Indigenous, Black, and other directly impacted communities.

Companies behind the Atlantic Coast Pipeline for fracked gas announced they are abandoning the 600-mile project, after six years of people-powered resistance. The project would have disproportionately polluted the air of a historic Black community in Virginia built by formerly enslaved people and threatened sacred Indigenous sites along its route to North Carolina.

The Dakota Access Pipeline is not yet defeated. But, in a testament to the resistance of the Standing Rock Sioux and other Indigenous peoples, a judge has ordered that its owners must drain it of oil and shut it down by early August, while a new environmental review is conducted. Pipeline owner Energy Transfer has indicated it does not plan to comply, setting up a standoff and proving yet again how the out-of-control fossil fuel industry sees itself as above the law.

The Keystone XL tar sands pipeline, powerfully opposed now for over a decade, could (once again) be dead. The U.S. Supreme Court agreed that its construction cannot move forward, meaning its fate will likely rest with the next U.S. president. Unfortunately, the court is allowing other dangerous projects based on the same flawed permit to move ahead.

The growing power of the climate movement made Monday a “grim day for pipelines,” as Bloomberg put it. Pipelines are becoming “almost impossible to build” for another reason, too: They’re bad, unnecessary investments. The gas that would have flowed through ACP wasn’t needed. The oil industry is loaded with debt and unburnable assets. And banks, insurers, and asset managers are under growing pressure to choose sides: either Stop the Money Pipeline into the fossil fuel industry, or stay on the wrong side of history.

–The OilWire Team

The Data

A new must-read paper from Greg Muttitt, formerly with OCI, and Sivan Kartha of the Stockholm Environment Institute proposes five principles for managing an equitable global phase-out of fossil fuel extraction.

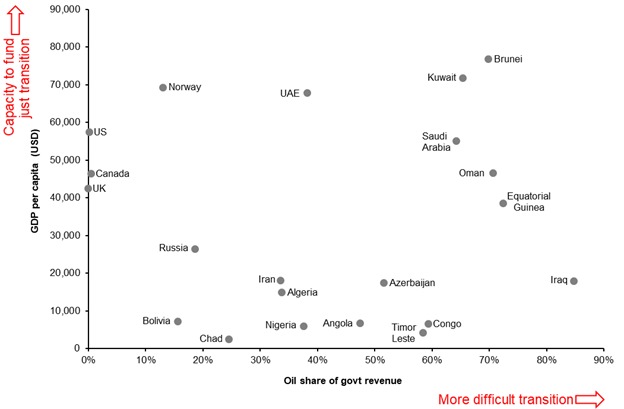

The chart below, taken from their piece in Climate Policy, reinforces why OilWire frequently calls out countries like the United States, Norway, Canada, and the UK as places that should act fastest in phasing out extraction.

Wealthy, diversified economies are best positioned to lead in a necessary just transition that leaves nobody behind – they have greater capacity to invest in support measures and less reliance on oil and gas to fund public services.

Don’t let paywalls deter you from reading the full piece: Find a blog post from the authors and the accepted manuscript.

Relative transition challenges of oil-producing countries

Oil’s share of central government revenue versus per-capita GDP (PPP), selected countries, 2016 (or nearest year for which data available). Source: Greg Muttitt and Sivan Kartha, “Equity, climate justice and fossil fuel extraction: principles for a managed phase out,” Climate Policy, May 2020.

What We’re Tracking

Relief and recovery: Bailouts for people or polluters?

UK funds climate and human rights disaster: Mozambique LNG

Over the weekend Reuters reported that the UK export credit agency, UKEF, is set to provide USD 800 million in financing to support fossil gas extraction in Mozambique, an amount equal to 50 percent of the UK’s annual climate finance. Next to being a climate disaster, the LNG developments are fueling human rights violations, corruption, violence, and inequality. Hundreds of people have already been forced out of their homes and journalists reporting on the developments have gone missing.

As the UK prepares to host COP26 next year, its decision to back new gas developments with taxpayers’ money undermines its climate credibility. As Mohamed Adow of Power Shift Africa writes: “there’s no need for Britain to double down on failing fossil fuels in Africa when we are blessed with almost endless wind, sun and geothermal energy. […] Britain could be using its world-leading expertise to help us harness our abundant renewable energy potential, and build the technology of the future.”

Please support this call for international solidarity from Friends of the Earth and follow the #NoGasMoz hashtag for updates.

Sneak peak: G20 stimulus packages pour more money into fossil fuels

On July 15, a group of 14 organisations led by the International Institute for Sustainable Development (IISD) will release a website tracking the energy sources G20 countries are supporting in coronavirus recovery packages. Unfortunately, preliminary findings show more public funds supporting fossil fuel rather than clean sectors, particularly in the United States, Russia, Australia, Canada, France, Indonesia, Saudi Arabia, South Korea and Turkey.

First summit of global development banks must end fossil fuel finance

This fall, the “Finance in Common Summit,” hosted by France, will bring together 450 public finance institutions. To meaningfully advance climate goals, the summit must deliver a joint commitment among public banks to end their finance for fossil fuels, argue Sandrine Dixson-Dècleve of the Club of Rome, Indigenous advocate Hindou Oumarou Ibrahim, and European parliamentarian Bas Eickhout.

U.S. Big Oil bailout continues on multiple fronts

Analysis by Influence Map shows that, as part of its COVID-19 purchase program, the U.S. Federal Reserve is buying up fossil fuel bonds at a disproportionate rate, relative to the sector’s 3 percent share of the stock index. Eight percent of the first USD 1.3 billion in bond purchases supported fossil fuel companies, or just under USD 100 million. “Junk bonds” comprise about one quarter of that total. At the same rate, the Fed could end up purchasing USD 19 billion of high-risk fossil fuel bonds through its USD 250 billion program, which is just one of several sources through which the industry is seeking a bailout.

In other U.S. bailout news, analysis by Documented and The Guardian finds that more than 5,600 companies in the fossil fuel industry have taken at least USD 3 billion in coronavirus payouts through the Paycheck Protection Program, one of several COVID-19 corporate relief funds.

African countries need financial support to leapfrog fossil fuels in COVID-19 recovery

Reuters interviews African energy experts on the recovery choices many countries are facing: to leapfrog to renewable energy, or pursue a last dash to pump more oil and gas? The pandemic is “raising awareness of the risks of relying so heavily on revenue from fossil fuels.” Large-scale investment in renewable alternatives would be more effective in accelerating energy access and sustainable development, but countries will need financial support to pursue this “once-in-a-generation opportunity” – support that G20 public finance institutions should accelerate alongside the phase-out of their billions in fossil fuel finance.

Fossil fuel fingerprints on the European Green Deal

Corporate Europe Observatory documents how the fossil fuel lobby has undermined efforts to secure a truly transformational European Green Deal by pushing emissions trading schemes and false solutions like CCS, fossil-based hydrogen, and fossil gas, rather than a full fossil fuel phase-out. In the first 100 days of lobby meetings on the European Green Deal, fossil fuel industry representatives met with key European Commission executives an average of two times per week.

Norway moves to expand oil and gas tax incentives; Big Oil pushes ahead with drilling in response

Norway’s government agreed last month on a plan to extend almost USD 1 billion in tax breaks to the nation’s Big Oil and Gas companies. Just days later, Aker BP and Equinor said they would go ahead with several new offshore drilling projects. Previous research by the Stockholm Environment Institute shows how the government’s support leads to more oil production and more global CO2 emissions.

Central banks: Sustainable recovery steps would include penalizing dirty assets

Central banks have been critical to managing the massive financial instability caused by COVID-19, but have not yet shown leadership in aligning those responses with climate imperatives. Two reports released in June, by Finance Watch and the Grantham Institute at LSE, outline measures central banks should take to tackle the looming financial crisis of climate change. Both reports point to appropriate risk weighting of oil, gas, and coal in banks’ balance sheets as a key tool. This would provide protection against asset stranding and disorderly transitions, therefore maximising financial stability.

Racial justice = climate justice

In this edition of OilWire, we’re sharing some of the Black Lives Matter work we’re following from leaders within the climate movement, because to truly fight for climate justice we must dismantle the white supremacist systems that are destroying lives and driving the crisis:

Tamara Toles O’Laughlin, North America director for 350.org, in Grist: “[T]he system is not broken, but rather operating as designed – which begs the questions: Are you willing to hold accountable all of the systems built off white supremacy – from the fossil fuel industry to racist policing to the prison industrial complex – in defense of the planet?”

Mary Annaïse Heglar, writer in residence at Columbia University’s Earth Institute, in Huffington Post: “It’s not just time to talk about climate – it’s time to talk about it as the Black issue it is. […] In other words, it’s time to stop #AllLivesMattering the climate crisis.”

Yale Environment 360 talks to Elizabeth Yeampierre, co-chair of the Climate Justice Alliance: “A lot of times when people talk about environmental justice they go back to the 1970s or ‘60s. But I think about the slave quarters. […] The idea of killing Black people or Indigenous people, all of that has a long, long history that is centered on capitalism and the extraction of our land and our labor in this country.”

Rev. Lennox Yearwood Jr., President & Founder of Hip Hop Caucus, on Shondaland: “[T]he work that everyone should be doing right now is examining their own role in upholding racism and white supremacy. When you do this work, I encourage you to look at the climate crisis and racism through the same lens, for it truly is the same problem.” Also read Rev. Yearwood on why the language of “brown finance” in climate finance is racist.

Dany Sigwalt of the Powershift Network wrote this Medium post on why our work depends on ending police violence: “To win on climate, we need to reinvent the power structures that haven’t functionally changed since slavery.”

The MIT Technology Review interviews Rhiana Gunn-Wright, director of climate policy at the Roosevelt Institute and an architect of the U.S. Green New Deal:

“[C]limate change is not just a technical problem. It’s not just an issue of emissions. It’s an issue of the systems that have allowed an industry that essentially poisons people to continue.”

Ayana Elizabeth Johnson, in The Washington Post and Heated, on her experience as a Black climate expert: “[T]his other intersection of race and climate doesn’t get talked about nearly enough: Black Americans who are already committed to working on climate solutions still have to live in America. […] Climate work is hard and heartbreaking as it is. […] When you throw racism and bigotry in the mix, it becomes something near impossible.”

In Grist, five U.S. environmental justice leaders share their takes on addressing the compounded threats of racial injustice, climate change, and COVID-19.

Trends in the Right Direction

Here’s a roundup of more signs of progress, on top of the pipeline victories highlighted upfront:

First Mover Alert: Ireland’s new government agrees to ban new oil and gas licensing

Political parties in Ireland have secured an agreement to form a new coalition government that could make Ireland a first mover in keeping oil and gas in the ground. The programme for government includes a Green New Deal which sets out ambitious climate targets. Crucially, the plan also includes a commitment to end new licenses for gas exploration and production, and to end government support for infrastructure to import fracked gas. Such supply-side measures would establish Ireland as a leader in this area. Despite the significant ambition, however, some questions remain. The government failed to come up with a plan to wind down existing licenses, and fossil fuel subsidies (which amount to EUR 2.5 billion per year) are not addressed.

Let’s put ‘sue Big Oil week’ on repeat

The last week of June turned into “sue Big Oil week” in the United States. The Attorney General of Washington, D.C. sued ExxonMobil, Chevron, BP, and Shell, for deliberately deceiving the public on the impacts of climate change. This followed a lawsuit filed the previous day by the Minnesota Attorney General against ExxonMobil, the American Petroleum Institute, and Koch Industries for consumer fraud. This suit is unusual in that it targets an industry lobbying group, which could create a precedent for future cases. The Minnesota and DC cases join 14 other ongoing lawsuits filed by U.S. cities, counties, and states against fossil fuel companies.

Pennsylvania goes on offense on fracking

Texas-based fracking company Cabot Oil and Gas is finally facing criminal charges in Pennsylvania over faulty gas wells that polluted the local water supply of the town of Dimock. The case is well-known due to its depiction in 2010 documentary GasLand.

Shortly after bringing charges against Cabot, Pennsylvania’s Attorney General released the results of a state grand jury report on fracking. The report contains testimony from residents regarding the impacts of fracking, including widespread accounts of headaches and nausea, as well as small children repeatedly waking up with severe nosebleeds. The report is highly critical of the failures of state regulators to protect public health.

The Pope and Queen Elizabeth back divestment

The Vatican is calling on Catholics and the private sector to divest from fossil fuels “progressively and without delay,” in a recent papal encyclical. Pope Francis also urged richer countries to provide financial support to poorer countries.

The UK’s Queen Elizabeth II is also beginning to pull money out of fossil fuels. Coutts, the Queen’s private banker and wealth manager, plans to cut carbon emissions by 25 percent across its portfolios before the end of 2021. To start, it will introduce screens that exclude companies that get more than 5 percent of their revenue from oil sands, Arctic oil and gas exploration, and thermal coal.

Campaign News

Big insurance companies pushed to unfriend oil and gas

A coalition of NGOs is calling on the insurance industry to move beyond coal exclusions and end all support for new oil and gas projects. The Unfriend Coal/Insure Our Future campaign issued an open letter to insurance industry CEOs last month. The letter argues that in order to achieve the goals set out in the Paris Agreement, the whole fossil fuel industry must shrink rapidly, and the insurance industry has a key role to play in supporting this transition.

They also released supporting research that identifies the 15 biggest providers of cover to the oil and gas industry, led by AIG, Travelers, and Zurich. Major insurers that have ended or limited their support for coal but continue to cover oil and gas include Allianz, AXA, Chubb, The Hartford, Munich Re, Zurich, and Swiss Re. Given the top-10 carriers control more than 70 percent of the market, “even a few leading insurers taking action will have strong impacts” on the industry.

Not Just a Canadian Phenomenon: Citizen opposition to oil and gas production around the world

A new report from Environmental Defence debunks a tired talking point used by oil and gas interests in Canada: that their industry is being “unfairly targeted” by campaigners. The research shows that Canadian groups receive a relatively small share of global philanthropic dollars that support anti-fossil fuel campaigns, compared to the size of Canada’s oil and gas sector. The report also documents how people-powered opposition to fossil fuel production is intensifying around the world through blockades, moratoriums, lawsuits, and divestment campaigns.

Industry News

Under investor pressure, BP, Shell, and Eni write off billions in reserves

The converging crises of COVID-19 and climate have initiated an inevitable reckoning for oil majors: that the value of their companies is built upon unburnable reserves. Under pressure from investors, BP has lowered its benchmark Brent oil forecast from USD 70 to USD 55, writing off up to USD 17.5 billion in reserves. Similarly, Shell also cut its price forecast, resulting in write-offs of up to USD 22 billion; 40 percent of which are attributed to Shell’s gas assets, demonstrating that gas is not a bridge fuel, nor a safe investment. Italian energy group Eni has also slashed the value of its assets by USD 4 billion.

These actions confirm what climate campaigners and commentators have been saying for years: that infinite forecasts for increased fossil fuel demand were not only unrealistic but destructive, and these assumptions have underpinned a systemic overvaluation of fossil fuel industry assets. These impairments are a reality check for the industry, but far from the commitments these companies should be making: to end expansion and manage a decline in production that aligns with a 1.5-degree warming limit.

Total pushes ahead with more exploration off the coast of South Africa

Bloomberg reports that Total has deployed an oil rig to South Africa to explore an offshore area adjacent to a 1 billion barrel gas-condensate discovery the company announced last year. Total’s continuing investment in new exploration directly contradicts the company’s recent claims of increased climate ambition.

Chesapeake Energy files for bankruptcy

Chesapeake Energy, an early driver of fracking technology, has become the largest U.S. oil and gas company to seek bankruptcy protection so far in 2020. Around twenty U.S. oil and gas companies that have filed for bankruptcy since the onset of the COVID-19 pandemic. The company had amassed USD 9 billion in debt. Yet its executives will continue to receive millions in corporate payouts. The Trump administration has also allowed Chesapeake to suspend drilling on more than 100 federal leases without forfeiting them – which is typically required.

Yet more evidence of massive, unreported methane leaks

Increasing use of satellite technology to monitor for methane leaks is making it ever more clear that “leaky oil and gas industry infrastructure is responsible for far more of the methane in the atmosphere” than has been reported. For example, last fall a European satellite detected a massive methane leak from the Yamal pipeline linking Siberia to Europe, estimated to have equaled the annual carbon emissions of 15,000 U.S. cars.

BP wants to be more like Greta?!

A remarkable leaked package of BP rebranding materials from January 2020 lays out the company’s strategy: talking about rewiring global energy, describing climate change as the most pressing crisis of our time, and repeating the words “energy transition” – all while planning to grow its oil and gas business.

U.S. utilities bypassing unnecessary gas ‘bridge,’ going straight to renewables

In the span of one week in June, utilities in three U.S. states announced plans to close one or more coal plants and build new renewables in their place, according to a new update from the Institute for Energy Economics and Financial Analysis (IEEFA). “What is clear is that transitioning from coal to renewables can be done now, cost effectively and reliably, without an interim shift to gas,” IEEFA writes. These are the same economics that ultimately made the Atlantic Coast Pipeline a bad investment.

Resources

New blog series: Fossil fuel end game

COVID-19 has brought fossil demand down, and if we are smart about recovery programmes it will never go back to pre-COVID levels. A new blog series by Leave It In the Ground (LINGO) will consider what could happen in the fossil end game: What happens when fossil fuel companies collapse, who loses, who wins, which pitfalls you should be aware of and which opportunities may arise? Read the introduction to the series. Each new piece will be shared on the LINGO website and linked to in OilWire. Stay tuned!

Gas in Mozambique: A windfall for the industry, a curse for the country

A new report by Friends of the Earth France, Mozambique, and International, examines France’s role in a gas mega-project off the coast of Mozambique. The report sets out the history of the project and the role of French institutions (public and private) in human rights abuses, corruption, and destabilisation in the region. It calls on companies to stop perpetuating fossil fuel dependence and withdraw from the project.

Gas Bubble: Tracking global LNG infrastructure

A report released this week by Global Energy Monitor (GEM) finds that nearly half of the world’s pre-construction LNG infrastructure projects are facing delays to financing, reflecting both deteriorating economics and rising public opposition to fossil gas development. The failure rate for proposed LNG export terminal projects was 61 percent over the 2014 to 2020 period.

Risks grow for Japan’s USD 20 billion LNG financing spree

A June report from GEM provides the first comprehensive project-level survey of LNG infrastructure projects supported internationally by Japanese public monies and private banks. GEM finds that, between January 2017 and June 2020, Japanese financial institutions provided at least USD 23.4 billion of financing to more than 20 LNG terminals, tankers, and associated pipelines spanning 10 countries.

Green Strings: Principles and conditions for a green recovery in Canada

A new report released by IISD and endorsed by leading environmental groups in Canada sets out seven “green strings” that should be attached to any government measures for economic recovery from COVID-19. The “strings” include support for a just transition that prepares workers for green jobs.

Why fossil fuel exports are a poor solution to Argentina’s debt crisis

Fundación Ambiente y Recursos Naturales (FARN) published its 12th annual report on Argentina’s most pressing environmental challenges. In this chapter (translated to English) Research Director María Marta Di Paola unpacks “The (dis)illusion created by fossil fuels.” The development of fracking in Vaca Muerta was presented as a means to improve Argentina’s access to foreign currency and repay foreign debt, with estimates showing that 20 percent of exports should be allocated to debt repayments in the next three years. However, that would require expensive new infrastructure and significant fiscal support by the state. Di Paola concludes, you cannot “solve a crisis that needs dollars with a ‘solution’ that requires even more dollars.”

The Carbon Tracker Initiative has released three new reports:

Absolute Impact: Why oil majors’ climate ambitions fall short of Paris limits: This analyst note evaluates the climate targets of the seven oil majors plus Equinor and Repsol on a relative basis against three “Hallmarks of Paris Compliance.” The note assesses whether pledges reduce Scope 3 emissions on an absolute basis, account for the company’s full equity share of production, and set timely interim and long-term reduction targets.

It’s Closing Time: The huge bill to abandon oilfields comes early: Fossil fuel companies have vastly underestimated the cost of shutting down old oil and gas infrastructure by discounting it into the future. This report finds that the early closure of many wells in recent months has created retirement liabilities for which the industry is not prepared. Where insolvent companies are not able to pay to shut down wells, the state will have to pick up the costs, shifting the financial burden to the public.

Decline and Fall: The size and vulnerability of the fossil fuel system: This report calculates the size and vulnerability of different parts of the fossil fuel system while examining how the COVID-19 crisis is accelerating its disruption. The analysis finds that “falling demand, lower prices and rising investment risk is likely to slash the value of oil, gas and coal reserves by nearly two thirds,” posing a major threat to global financial stability if governments do not take action to ensure an orderly wind-down.