THE BIG PICTURE

Keystone XL is finally dead. On June 9, TC Energy confirmed that it would terminate the Keystone XL pipeline. The pipeline would have increased the flow of dirty tar sands oil from Alberta, Canada into the United States en route to refineries in the Texas Gulf Coast. It was blocked by U.S. President Joe Biden’s administration in January of this year.

This final nail in the zombie pipeline’s coffin is a tremendous victory for all the Indigenous communities, landowners, farmers, ranchers, and climate activists along its route and around the world who have fought this project for over a decade.

TC Energy’s announcement has intensified calls for President Biden to stop the Line 3 and Dakota Access oil pipelines.

This came after a watershed month for campaigning against oil and gas. First, on May 18, the International Energy Agency (IEA) released its first fully-fledged, 1.5 degrees Celsius-aligned energy scenario, backing up what campaigners have said for a while now: we must stop expanding fossil fuel extraction. Then, on May 26, activists secured a remarkable win in court against Shell, and shareholders won unprecedented votes to force change at ExxonMobil and Chevron.

Several international media outlets and campaign organisations reported May 26 as some variant of “A very bad day for Big Oil”. That is true. But, as Emily Atkin notes at Heated, this was also a very good day for life on Earth, and it is important not to let the political framing of these wins overshadow what’s at stake for people’s lives and livelihoods. This is a fight for all our futures, not just a fight against Big Oil and Gas.

– The OilWire Team

THE DATA

In May, the IEA released its first energy scenario aligned with the Paris goal of limiting global warming to 1.5 degrees Celsius (ºC). It has huge implications for the oil and gas industry, particularly given the role the IEA has historically played in boosting the industry’s case for new investment and infrastructure.

A headline finding of the IEA’s ‘net zero roadmap’ is this: “There is no need for investment in new fossil fuel supply” – meaning governments and fossil fuel companies should stop developing new oil and gas fields to be aligned with the 1.5ºC limit.

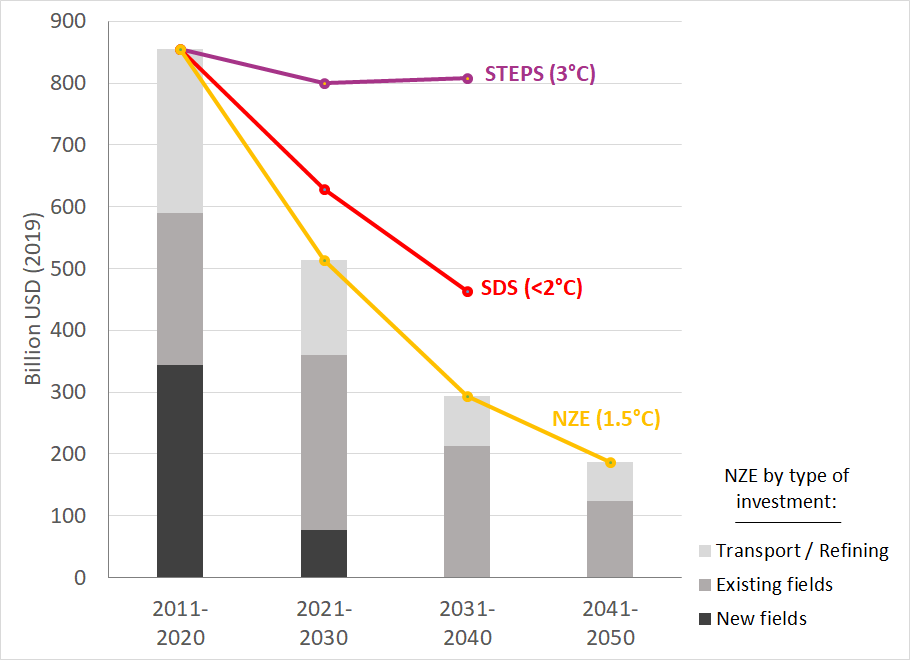

The figure below shows the implications of this shift in terms of the IEA’s projections for investment in oil and gas supply, comparing the new “Net Zero Energy” (NZE) scenario to scenarios from the agency’s 2020 World Energy Outlook.

Projected oil and gas supply investment, annual average by IEA scenario

Sources: IEA Net Zero by 2050 report, WEO 2020, Oil Change International analysis; SDS = Sustainable Development Scenario; STEPS = Stated Energy Policies Scenario.

Key takeaways include:

- In the NZE scenario, investment in new oil and gas fields is limited to those already under construction or approved this year.

- From 2021-2040, the NZE scenario indicates a 35% drop in cumulative oil and gas supply investment compared to the IEA’s previous benchmark climate scenario, the Sustainable Development Scenario.

- Given the NZE scenario still includes problematic assumptions around fossil gas and carbon capture and storage (CCS), the investment declines shown above need to be steeper to minimise risks to people and ecosystems.

WHAT WE’RE TRACKING

Trends in the right direction

Historic wins against three of the world’s largest oil companies increase climate pressure on the sector

Last month, Shell experienced a historic loss in the Dutch courts, and both Exxon and Chevron faced major shareholder rebellions on climate issues. Commentators say this represents a significant escalation in pressure on the sector to align with the zero carbon transition.

Shell ordered to cut emissions faster: In the Netherlands, Shell was mandated to comply with the Paris Agreement targets and reduce its emissions by 45% by 2030 below 2019 levels. The groundbreaking case was brought by Milieudefensie, the Dutch branch of Friends of the Earth, and establishes a precedent on corporate liability for climate change. This is the first time a court has ruled that a corporation (a big oil and gas company) has a legal duty to reduce its emissions in line with pathways for staying below 1.5ºC of global warming.

Importantly, the court rejected Shell’s arguments that it can only move as fast as society moves on climate action, and that their investments only respond to continued demand for oil and gas. The ruling states that Shell is “free to decide not to make new investments in explorations and fossil fuels, and to change the energy package offered by the Shell group, such as the reduction pathways require.”

U.S. companies overruled on emissions targets: In the U.S., many major oil and gas companies have thus far refused to set emissions reduction targets for their largest chunk of emissions – those from burning the oil and gas they extract (e.g., scope 3). Shareholders are now forcing action: 58% of investors in ConocoPhillips backed a resolution urging the company to set targets to reduce all scopes of emissions. At Chevron, 61% of shareholders voted in favour of a proposal to cut the company’s Scope 3 emissions by 45% by 2030. Proposals at Chevron for increased transparency on the potential impact of reduced oil demand and political lobbying were only narrowly rejected.

Exxon shareholders shake up the board: On the same day, investors in Exxon demonstrated their disappointment in the company’s poor financial and environmental performance by voting against management to appoint three new board members, a first for the industry. The new board members were proposed by activist investor Engine No. 1 in a campaign supported by larger investors including CalPERS and CalSTRS. They called for greater investments in clean energy and an overhaul of executive remuneration. While this demonstrates investors’ willingness to take more aggressive action at laggard companies, it’s unclear what scale of change newly elected board members will support, given their backgrounds in oil and gas management and big tech.

These victories could signal a “tipping point” towards increased scrutiny of and accountability for Big Oil and Gas companies in courtrooms and boardrooms. However, on the whole, companies’ climate plans remain “grossly insufficient”. Staying below 1.5ºC at a global level is still likely to hinge on governments stepping in to manage a rapid and equitable phase-out of production.

Dutch development bank FMO will end its fossil fuel investments

Dutch bank FMO has committed to phase out its investments in fossil fuels. The bank will cease direct investments in upstream and midstream fossil fuels, and phase out midstream and downstream fossil fuel activities for power generation within five years. Investments in gas may be made under “exceptional” circumstances. The commitments come on the back of a 2020 consultation process.

Campaign news

G7 fails to deliver on calls to stop funding fossils, cancel debt, and up climate finance

Ahead of the G7 summit in mid-June, more than 350 groups from 58 countries as well as over 100 economists sent separate letters urging the leaders of these rich countries to finally stop financing fossil fuels. Instead of pumping more public money into fossil fuels, organisations called on the G7 to cancel debt payments and pay their fair share of climate finance for Global South countries grappling with the costs of the COVID-19 pandemic and the climate crisis. Unfortunately, world leaders at the summit failed to deliver meaningful outcomes that go beyond inadequate pledges already made.

While the G7 committed in May to end international finance for coal power after 2021, research released this month by the International Institute for Sustainable Development (IISD) shows wealthy countries are funneling massive amounts of international finance into fossil gas – four times more than is being given to wind and solar.

Climate hypocrisy: UK poised to approve new oilfield ahead of COP26

Earlier this month, 50 campaign groups, including Greenpeace, Oxfam, and Oil Change International, signed a letter urging the UK to end licensing for new oil and gas extraction in the North Sea and “get its own house in order” as it prepares to host COP26. Instead, the UK government signaled this week that it plans to approve development plans for a new oilfield off the coast of the Shetland Islands, a move called “completely indefensible” by Scottish campaigners. The Cambo project, proposed by Siccar Point Energy and Shell, could produce 150 million barrels of oil and operate to 2050, beyond the point when Scotland has committed to be carbon neutral.

At the end of May, Scottish climate activists launched a legal challenge to the UK Oil and Gas Authority’s strategy of “maximising the economic recovery” of hydrocarbons, which they say is at odds with the UK’s own legally binding climate targets. More information can be found here.

Costa Rican president pushes for permanent fossil fuel exploration ban

Costa Rican President Carlos Alvarado convened parliament last month to discuss a new bill that would permanently ban licensing for fossil fuel extraction in the country. While Costa Rica has had an executive moratorium on oil and gas exploration since 2011, some business and political groups – including candidates for the February 2022 national elections – have been pushing for new exploration. The proposed bill would put an end to exploration for good. Parliament may decide by the end of July.

Norwegian People vs. Arctic Oil case progresses to the European Court of Human Rights

This month, six young climate activists in Norway (alongside Greenpeace Nordic and Natur og Ungdom, the youth branch of Friends of the Earth Norway) filed a case in the European Court of Human Rights. They argue that the Norwegian state is violating their fundamental human rights by pursuing Arctic oil drilling. Norway’s domestic courts previously ruled that the state did not violate the Norwegian Constitution, which guarantees every person a right to a healthy environment. The applicants state that the courts did not accurately account for the consequences of climate change for future generations. They will now argue that Norway is in breach of the European Convention on Human Rights. The filing followed the Norwegian government’s authorisation of 84 new areas for petroleum exploration and production this month.

ReconAfrica faces complaints over deceptive stock promotion of Kavango Basin drilling project

Campaigners are launching new challenges to Canadian company ReconAfrica and its controversial plans to drill in the Kavango Basin of Namibia and Botswana. A Canadian group filed a complaint with the British Columbia Securities Commission in early June, alleging that ReconAfrica has misled investors in the marketing of its project. This follows a whistleblower complaint filed with the U.S. Securities and Exchange Commission last month. In a slew of recent promotional campaigns that sharply boosted its stock price, ReconAfrica has claimed its drilling project may generate 120 billion barrels of oil and “phenomenal riches”, despite not yet having any proven reserves.

As part of a week of action around the company’s June annual meeting, 185 organisations – including 40 based in southern Africa and 85 in Canada – sent an open letter to Prime Minister Justin Trudeau and other Canadian government officials. The groups are calling for a federal investigation into the company’s plans and the use of all legal and diplomatic avenues to prevent the harm they pose to human rights, Indigenous rights, local livelihoods, drinking water for over 1 million people, the global climate, and a critical and world-famous ecosystem.

Groups petition against new fossil fuel permits or expansions in New Zealand

Climate justice organisations in Taranaki, New Zealand launched a petition this month urging the government to stop new onshore oil, gas, and coal exploration or extraction permits, and to stop extending existing permits. Though the New Zealand government has been celebrated for its 2018 decision to stop any new offshore oil and gas exploration (which came after nearly a decade of Indigenous-led campaigning), the country is still issuing new onshore permits. One company, Todd Energy, has proposed 24 new wells around Tikorangi in the Taranaki region and onshore seismic surveying continues.

Insurers urged to reject Total’s tender for the East African Crude Oil Pipeline (EACOP)

As part of the international #StopEACOP campaign, groups have called on insurance and reinsurance brokers to reject a recent tender published by Total for insurance services for EACOP. The controversial pipeline project threatens the livelihoods and water resources of millions of people, as well as running contrary to the global goal of limiting global warming to 1.5ºC. Total’s effort to mobilise insurance for EACOP comes shortly after several of the world’s largest commercial banks made public commitments to not finance the project.

Spotlight on Line 3 pipeline fight grows as construction resumes

As construction on the U.S. section of Enbridge’s Line 3 tar sands oil pipeline resumes following a two-month pause, anti-pipeline protests have thrust the fight into national and international headlines. Led by Indigenous water protectors at five frontline camps along the pipeline route, thousands of people traveled to the U.S. state of Minnesota this month for the Treaty People Gathering. Pipeline resisters established a new encampment where Line 3 would cross the Mississippi River, hundreds of people were arrested, and local and national security forces inflamed tensions by attacking protestors with helicopters and more. All of this has massively increased pressure on President Biden to stop the pipeline, which he can do at any time.

More headlines

Biden’s first 100 days of U.S. presidency fall short on climate and phasing out fossil fuels

New U.S. President Joe Biden’s campaign pledges on climate leadership have come under scrutiny, after a mixed track record through his first 100 days in office. While his administration has revoked a key permit for the Keystone XL pipeline, continued pushing to eliminate fossil fuel subsidies, and recently issued a broad-ranging executive order to address climate-related financial risk, other moves have propped up the fossil fuel industry and its deadly pollution:

- Biden and his climate team have allowed the Dakota Access oil pipeline to continue operating, despite the pipeline lacking critical permits and endangering Indigenous communities, water, and the climate.

- While Biden paused oil leases in the Arctic National Wildlife Refuge, his administration recently defended the Trump administration’s approval of another massive drilling project in northern Alaska, ConocoPhillips’ Willow project.

- In spite of the Biden administration’s moratorium on new federal oil and gas leases, the U.S. Interior Department has already issued dozens of fossil fuel leases auctioned off in the final few weeks of Trump’s presidency.

- Biden’s energy secretary has promoted the sale of liquified natural gas internationally, despite the mounting scientific consensus that expanded gas infrastructure will prevent the world from meeting its climate targets.

- While Biden’s first proposed budget revokes key tax concessions from the oil and gas sector, it also proposes new support for fossil fuel-derived hydrogen and CCS.

Texas governor attempts to block U.S. federal regulation of state oil and gas sector

The Permian Basin in the U.S. states of Texas and New Mexico has one of the largest oil deposits in the world, accounts for 40% of U.S. oil production, and is the country’s largest source of methane. Despite the fact that federal efforts to enforce regulations and restrictions on methane have largely failed, Texas’ governor recently signed an executive order compelling state agencies to challenge any U.S. federal action that threatens the state’s fossil fuel sector. Because much of the Permian extraction zone in Texas is owned by private landowners or the state, this presents a new challenge for U.S. national leaders to enforce emissions reductions in the region. Advocates are ramping up pressure on President Biden to declare a national climate emergency and reinstate the crude export ban that was lifted in 2015.

Canadian ‘Net Zero’ tar sands alliance veils plans for increased oil production

Canadian Natural Resources, Cenovus Energy, Imperial, MEG Energy, and Suncor Energy announced the formation of the Oil Sands Pathways to Net Zero earlier this month. These companies operate 90% of Canada’s tar sands extraction. The alliance has been criticised as “absurd” greenwash, since it includes no meaningful commitments to wind down production. The ‘net zero’ pledge excludes emissions caused by burning the fossil fuels actually produced and depends on large-scale CCS projects. Recent analysis by the Stockholm Environment Institute found that planned oil production in Canada is on track for 17% growth by 2030.

Industry news

Renewable energy responsible for majority of U.S. emissions savings, contrary to American Petroleum Institute claims

The American Petroleum Institute (API), a U.S. lobby group notorious for spearheading climate disinformation campaigns, is back to its old habits of making misleading claims about U.S. emissions. API recently suggested that emissions reductions from the U.S. power sector are due to switching from coal to gas. However, the data suggests otherwise. Analysis from Oil Change International shows that when methane emissions and energy efficiency savings are fully accounted for, growth in renewable energy made by far the biggest contribution to emissions reductions.

ExxonMobil affiliate ordered to pay damages over Nigerian oil spill

Earlier this week, a federal court in Nigeria held an ExxonMobil affiliate and the Nigerian National Petroleum Corporation negligent over oil spills in the Akwa Ibom State, ordering the company to pay NGN 81.9 billion (around USD 200 million) in damages to local communities within 14 days. The lawsuit was brought by Ibeno communities whose land and water was polluted by spills from the companies’ old pipelines, affecting many livelihoods dependent on fishing and farming.

Oil industry on track to increase clean energy investment in 2021 – to 4 percent of its total

The IEA’s World Energy Investment 2021 report shows global clean energy investment increasing this year, but far off pace of the tripling needed by 2030 under the agency’s recent net zero scenario. IEA data indicates that the oil and gas industry will increase upstream spending by 10% this year, while staying below pre-pandemic levels. The proportion of oil and gas industry investment going towards clean energy is on track to increase in 2021 – but that’s from an extremely low baseline. The IEA estimates that 1% of total industry investment went towards clean energy last year, and that that could increase to 4% in 2021.

Oil and gas executives may face subpoenas in hearings on climate disinformation

In a move aimed at shedding light on climate change denial and disinformation campaigns, U.S. Congressman Ro Khanna, chair of the Oversight and Reform Subcommittee on the Environment, plans to invite fossil fuel and big tech executives to testify. Despite repeated invitations in the past, oil executives have refused to testify on their record of disinformation and obstruction. Khanna has stated he is prepared to issue subpoenas mandating their appearance, and the findings of such hearings could be “explosive” and parallel the tobacco industry congressional appearances in the 1990s.

Enbridge refuses to close Line 5 despite Michigan revoking permit

The U.S. state of Michigan has revoked a key permit for the Line 5 oil pipeline, operated by Canadian company Enbridge. Concerns continue to mount about rising carbon emissions, as well as the potentially catastrophic consequences of a leak in the pipeline, which runs through an area connecting two of the Great Lakes. In recent years, the 67-year old pipeline has been struck several times by anchors and cables, but Enbridge has refused to close the pipeline. The 1977 Transit Pipelines Treaty between the U.S. and Canada means that this conflict may need to be resolved at the federal level. This month, the Biden administration announced that it would require the pipeline to undergo a full federal environmental review.

Proposed Gulf Coast crude export project is environmentally harmful and out of step with U.S. climate commitments

A crude oil export project proposed in the U.S. Gulf Coast is facing protests from environmentalists and local fishing communities. The project plans to widen the channel in Lavaca Bay in order to allow for Very Large Crude Carriers to operate, threatening local wildlife and fishing livelihoods. Critics say it is out of step with the Biden administration’s commitment to halving emissions by 2030. U.S. crude exports have increased by 750% since the U.S. crude export ban was lifted in 2015.

RESOURCES

Net Zero Producers Forum: A catalyst for climate ambition or yet another delaying tactic?

A new briefing analyses the ‘Net Zero Producers Forum’ formed in April by fossil fuel producing nations: the United States, Canada, Qatar, Norway, and Saudi Arabia. Unless members align around the need for a managed and equitable phase-out of fossil fuel production in line with the 1.5ºC limit, the initiative will merely serve to facilitate greenwashing and delay meaningful climate action. Authors are: Oil Change International, Center for International Environmental Law, Climate Action Network Canada, Environmental Defence Canada, the Fossil Fuel Non-Proliferation Treaty Initiative, Friends of the Earth US, Greenpeace, and Stand.Earth.

Step Off the Gas: International public finance, natural gas, and clean alternatives in the Global South

A new report from IISD examines international public finance for fossil gas expansion in the Global South, finding it risks locking countries into high-carbon development pathways and jeopardising efforts to keep warming below 1.5°C. The report assesses economic and environmental risks from gas development, the status of alternatives to gas, and how to overcome challenges for the South in developing clean energy. It has detailed case studies of gas in three emerging economies: Argentina, Egypt, and India.

Fossil Fuel Exit Strategy: An orderly wind down of coal, oil, and gas to meet the Paris Agreement

A report released by the Fossil Fuel Non-Proliferation Treaty Initiative concludes that the world must both end expansion of fossil fuel production and phase down existing extraction projects to hold global warming below 1.5°C. The modelling, done by Dr. Sven Teske and Dr. Sarah Niklas from the Institute for Sustainable Futures, University of Technology, Sydney, further shows that the world has more than enough renewable energy resources that can be scaled up rapidly enough to replace fossil fuels whilst meeting energy demand.

Carbon Tracker releases updated assessment of oil majors’ climate commitments

Carbon Tracker analysis evaluates the climate targets of ten of the largest oil and gas producers. They find a number of key limitations that must be addressed. In particular, they highlight the need for targets to cover the full scope of emissions and include reduction goals for 2030 as well as 2050. The findings build on Carbon Tracker’s 2020 report Absolute Impact.

Impacts of 2020 Colonial Pipeline rupture continue to grow

The Colonial Pipeline is the largest pipeline system for refined oil products in the U.S. In August 2020, the pipeline ruptured, spilling more than 1.2 million gallons of gasoline – an amount at least 18 times greater than what Colonial Pipeline Co. had originally reported nine months ago. FracTracker looks at the issue through an interactive map and accompanying analysis.

Gas storage plan vs. Indigenous rights in Nova Scotia

The Mi’kmaq First Nations people, who live in communities across what is now known as the provinces of New Brunswick, Nova Scotia, Prince Edward Island, and Québec, are facing threats to their lands and water due to plans in Nova Scotia proposed by AltaGas. The Calgary, Canada-based corporation wants to expand storage and shipping of fracked gas in a massive USD 130 million project that would involve underground salt caverns and an extensive LNG export facility. FracTracker provides several maps, analysis, and resources to learn more.

Global Witness analyses Chevron’s history of systemic racism

Analysis from Global Witness finds that Chevron gave over five times more funding to politicians with F grades from the NAACP in the six months after the company’s public claim of support for the Black Lives Matter movement and communities of color. The oil major has a history of propping up systemic racism while trying to come across as a social justice champion.

Investing in Amazon Crude II: How the big three asset managers actively fund the Amazon oil industry

This Amazon Watch report sets out how three of the world’s largest asset managers – BlackRock, Vanguard, and State Street – with trillions of dollars under their control, invest in oil companies with horrific environmental and human rights records across the Amazon Basin. Together, the “Big Three” hold USD 46 billion in oil companies such as ENAP and Petroamazonas operating in the rainforest. The report includes case studies on oil company violations within Indigenous territories.