THE BIG PICTURE

September saw a landmark political development with Denmark and Costa Rica announcing they will form the Beyond Oil and Gas Alliance (BOGA). The diplomatic initiative will bring together countries and jurisdictions that have ended licensing for new oil and gas exploration and production and are setting an end date for their production. The official launch, announcing further details and potentially further governments that have joined, will happen at November’s COP26, in Glasgow.

Civil society around the world applauded the move. BOGA is the first diplomatic initiative acknowledging the need for governments to manage the phase out of fossil fuel production as a key tool to address the climate crisis. It has the potential to reshape the global debate by no longer allowing governments to claim to be climate leaders while opening up new oil and gas fields.

The future of oil and gas production was also one of the biggest issues in September’s parliamentary elections in Norway, Europe’s biggest producer. As negotiations to form a new government happen over the next few weeks, the question remains whether it will adopt a more restrictive oil and gas production policy.

Elsewhere, in an unprecedented move, the Finance Minister of Iraq, one of the founding members of OPEC, called on fellow oil producers to move away from fossil fuel dependency and into renewable energy.

–The OilWire Team

THE DATA

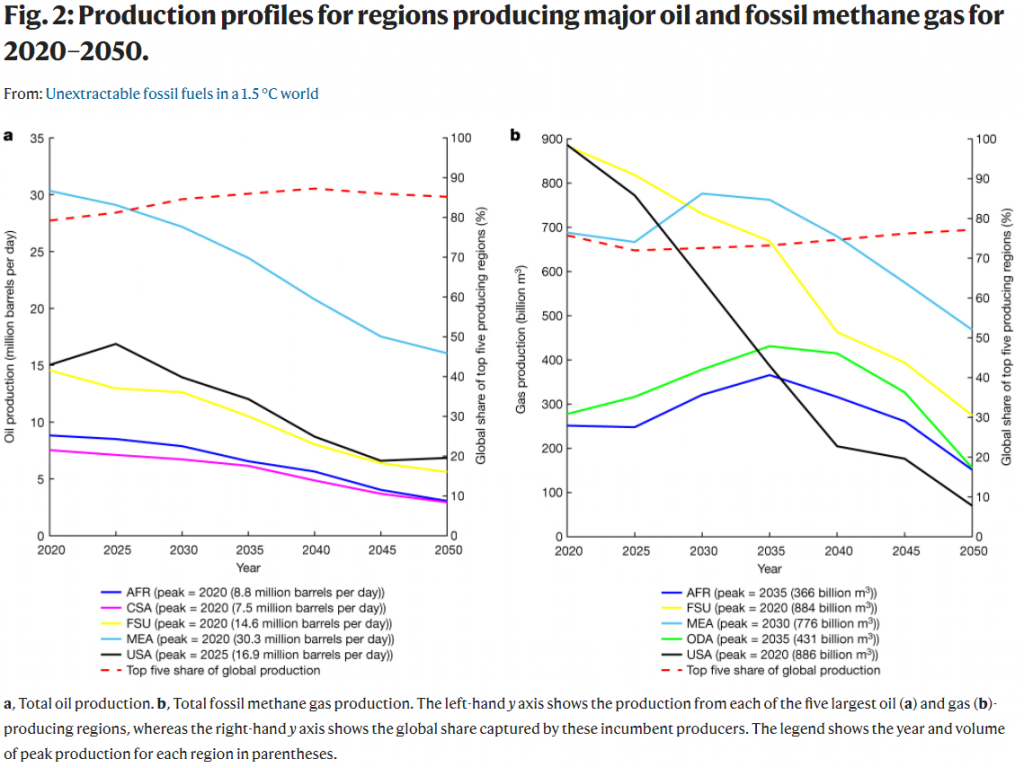

In September, Nature published updated modelling from researchers at University College London assessing how much of the world’s known fossil fuel reserves must stay in the ground to provide a 50% chance of staying within 1.5°C degrees of global warming. It also suggests rates of decline in oil and gas production for major producing regions under a 1.5°C limit (based on cost rather than equity).

Source: Welsby, D., Price, J., Pye, S. et al. Unextractable fossil fuels in a 1.5 °C world. Nature 597, 230–234 (2021). https://doi.org/10.1038/s41586-021-03821-8

Key findings include:

- Nearly 60% of oil and fossil gas reserves and close to 90% of coal reserves considered economic as of 2018 are unextractable in 2050, “rendering many operational and planned fossil fuel projects unviable.”

- Global oil and fossil gas production should have peaked in 2020 and decline steadily by 3% per year thereafter. The study says this rate of decline is likely an underestimate of what is required, given it relies on levels of carbon dioxide removal (4.4 Gt by 2050) on the edge of what is feasible.

- Fossil gas production in the United States should decline by an annual average of 8.1% through 2050.

- Canada has the highest rate of unextractable oil – 84% of tar sands reserves must stay in the ground.

WHAT WE’RE TRACKING

Trends in the Right Direction

Quebec announces end to fossil fuel exploration

The government of the province of Quebec in Canada has indicated it wants to prohibit permits for oil and gas drilling, but it faces legal challenges from the fossil fuel industry. Quebec’s recoverable reserves of gas, concentrated in the southern part of the St. Lawrence Valley, are estimated to be between 250 billion m3 and 1,150 billion m3.

Argentina’s government suspends environmental permits in offshore exploration areas

After intense campaigning and numerous complaints, including from the fishing industry, the government has suspended the granting process of environmental permits to companies including Equinor, Shell, and YPF until all public bodies have given their official input. This announcement is in part a response to previous calls from the Environment Ministry to have a full decarbonisation plan before approving offshore exploration.

Los Angeles County votes unanimously to phase out drilling

The board of supervisors voted five-to-zero in support of a measure to shutter over 1,600 active and idle oil and gas wells in Los Angeles County, an area with a population of over 10 million people. With this decision, LA County may become the first US county to phase out existing drilling. Ahead of the vote, groups submitted letters signed by 150 organizations and more than 4,000 petitions and comments to the Board urging them to protect Los Angeles communities by supporting the phase-out of what they identified as dangerous oil drilling. “This decision is a huge deal because it can potentially impact a very large number of people,” said Rachel Morello-Frosch, an environmental health scientist at the University of Berkeley, “and can also influence a statewide conversation about the regulation of upstream oil and gas production in California.”

Oil and gas divestment commitments roll in from influential investors

Quebec Deposit and Investment Fund (CDPQ), with USD 308bn assets under management, announced in its new climate strategy that it will divest oil assets by 2022 and encourage external managers to do the same. It cites a desire to avoid contributing to a growth in the global oil supply. The news follows Harvard University’s announcement that it has agreed to divest its USD 42bn endowment from fossil fuel companies after a decade-long campaign. Dutch pension funds PME and Horeca & Catering – with USD 90bn AUM – also announced they had divested from fossil fuels.

Campaign News

Mapuche communities take to the streets and the courts to stop extraction in Vaca Muerta

Four Mapuche communities blocked roads in protest at the mismanagement and lack of control of the hydrocarbon industry and fracking in Vaca Muerta, Argentina. A number of groups including the Confederation of Neuquén also filed criminal complaints related to seismic movements, oil waste treatment and water shortages.

The Uruguayan government seeks to extend the fracking moratorium for a further decade

This follows a previous moratorium in 2018 that expires this September. Government representatives said they want to protect the environment in Uruguay and give a strong signal to the international community.

52 congress representatives in Colombia have filed a bill to ban fracking

Pushed by the Colombian Alliance Against Fracking, 52 congress representatives of 10 different parties have, for the third time, presented a law to completely ban fracking in Colombia. This law would prohibit proposed test pilots, which are currently excluded from existing fracking moratorium policies in the country.

Australian oil and gas producer, Santos, is being taken to court over net zero commitments

The Australasian Centre for Corporate Responsibility (ACCR) who filed the landmark case against Santos in the Federal Court will challenge Santos’ claims that natural gas provides “clean energy” and that it has a “credible and clear plan” to achieve “net zero” emissions by 2040 in the Federal Court of Australia. ACCR claims this is the first court case in the world to challenge the veracity of a company’s net zero emissions target, and a world-first test case in relation to the viability of carbon capture and storage (CCS) and the environmental impacts of blue hydrogen.

World leaders urged to end public finance to fossil fuels

The President of the European Investment Bank and UK COP26 envoy penned an op-ed calling for other institutions to align international public financial support fully with the Paris goals. The op-ed follows a letter from over 200 civil society organisations from 40 countries which called on world leaders at the UN General Assembly to end international public finance for coal, oil and gas and to shift this money to clean energy and a just energy transition. Based on analysis from 2020, the letter states that G20 members provide at least three times as much international public finance for fossil fuels (USD 77 billion) as for clean energy (USD 28 billion) every year.

The International Union for Conservation of Nature (IUCN) congress voted in favour of motions to safeguard Okavango and the Amazon from oil and gas extraction.

In regards to the Okavango motion, the IUCN cited a recent announcement of the World Heritage Committee which expressed concern about the granting of oil exploration licenses in environmentally sensitive areas within the Okavango river basin. The Amazon motion was brought by the Coordinating Body for Indigenous Organizations of the Amazon Basin (COICA).

German oil and gas company Wintershall Dea faces legal challenge

NGO Deutsche Umwelthilfe (DUH) has sent a cease and desist letter to Wintershall calling for the company to halt its activities due to “climate-damaging business at the expense of our future”. The move comes as the company seeks to move forward with a public listing on the Frankfurt Stock Exchange.

More headlines

Public finance institutions in South Korea provide major support to oil and gas industry overseas

A new report claims that South Korea’s public financial institutions have provided more than USD 127bn for global fossil fuel projects over the past decade, making the nation the second largest public financier of oil and gas globally, after China. The new report by Korean NGO Solutions For Our Climate (SFOC) has analysed Korean public financial institutions, including the Export-Import Bank of Korea (KEXIM), Korea Trade Insurance Corporation (K-SURE), and Korea Development Bank (KDB). SFOC argues that such support contradicts South Korea’s commitment to become carbon neutral by 2050.

Legal ruling finds that companies cannot use the Energy Charter Treaty to block climate action

The Court of Justice of the European Union has confirmed that polluting companies cannot use the Energy Charter Treaty (ECT) to sue member state governments for profit losses resulting from the implementation of new climate and environmental legislation. The decision comes the same month it was revealed that oil and gas companies are suing governments for USD 18bn under the Treaty for losses due to climate action.

Campaigners call on governments and producers to stop the east African oil pipeline now

The controversial East African Crude Oil Pipeline (EACOP) continues to face opposition from local communities and civil society. Omar Elmawi, coordinator of the #StopEACOP campaign, highlights in an op-ed the potential environmental damage from the proposed pipeline: burning the 210,000 barrels of oil a day that would be transported by the pipeline would produce more than 34 million metric tonnes of carbon annually. This is significantly greater than the current combined emissions of Uganda and Tanzania, where the pipeline would run through. Elmawi and co-authors call on Total and the other major institutions supporting the project to heed UN Secretary General António Guterres’ call to immediately end all new fossil fuel exploration and production, in line with the IPCC’s findings.

LNG importer Karpowership challenged in public hearings

Turkish company Karpowership is proposing to install three floating power plants and associated floating storage and regasification units (FSRUs) off the South Africa coast. These will generate power using imported liquefied natural gas (LNG). The project, in sensitive ecological areas of Richards Bay, Coega and Saldanha Bay, is being challenged on a number of grounds.

UK political party proposes banning oil and gas from the London Stock Exchange

Liberal Democrat party leader, and former UK Secretary of State for Energy Ed Davey, has put forward a proposal to ban new listings of fossil fuel companies from the London Stock Exchange and to strike off companies without a coherent plan for achieving Net Zero emissions. An increasing number of oil and gas assets are being bought by private equity firms such as Neptune Energy and Wintershall, companies that are considering turning to public markets to raise new capital. This proposal would aim to close off access to this significant source of finance.

Industry News

Shell exits major fossil fuel assets but continues to plan for expansion

Shell has divested from the Permian Basin, the top producing oilfield in the US, based in Texas. The company sold its assets to US fossil fuel company ConocoPhillips for USD 9bn. The move does not represent a major shift in the company’s strategy, however; Wael Sawan, the company’s director of upstream, said the company would continue to invest in its top oil and gas assets globally. The U.S. will continue to account for around one-third of Shell’s global spending, as it focuses on its Gulf of Mexico position (where it is the largest producer). The oil major is also planning to sell off its onshore assets in Nigeria assets. A number of legal rulings found the company responsible for several oil spills there. The Environmental Rights Action/Friends of the Earth Nigeria (ERA/FoEN) has urged the company to remediate oil-polluted areas caused by its exploration activities before divesting its onshore assets in the Niger Delta region where the spills took place.

BHP looks to offload oil and gas assets to Woodside

Multinational mining company BHP has announced plans to divest from the oil and gas industry by merging its hydrocarbon business with Woodside Petroleum. The Australian environment and safety regulator has ordered BHP to clean up three of its offshore fields, and confirmed that decommissioning any responsibilities and costs would be passed to Woodside. The announcement has been met with mixed responses from credit rating agencies. S&P said it would damage their rating, while Moodys said it was positive from an ESG perspective. The Australasian Centre for Corporate Responsibility (ACCR) has expressed concerns that the merger will not deliver meaningful climate benefits.

Two of Canada’s largest oil and gas companies plan restart of major new offshore oil field as global players move on

The announcement comes after the government of Newfoundland and Labrador tried to win support for Terra Nova by committing more than USD 500-million to the project. Despite this public finance commitment, oil majors including Exxon, Shell, Equinor, and Chevron pulled out of the project, leaving Canadian companies Suncor and Cenovus.

Canada’s oil industry wants the Federal government to fund CAD 75 billion for carbon capture and storage (CCS)

A coalition of Canadian oil sands producers recently released a pathway to net zero for the sector that does not include plans to wind down fossil fuel production. Instead, the pathway relies heavily on plans for a new multi-billion dollar CCS facility, and the industry has asked for federal financial support to help foot the bill. Responding to the industry plea, Chris Severson-Baker, from think tank The Pembina Institute, argued that the potential government dollars could be better spent elsewhere. “It would make sense to take that additional public funding and put it towards industries that are going to be part of the economy in a carbon-constrained future for years to come rather than putting it towards something where the world is actively trying to get away from using that commodity.”

RESOURCES

Indigenous Environmental Network, Oil Change International; Indigenous Resistance Against Carbon

This report analyses the tangible impact Indigenous campaigns of resistance have had in the fight against fossil fuel expansion across what is currently called Canada and the United States of America. It quantifies the metric tons of carbon dioxide equivalent (CO2e) emissions that have either been stopped or delayed in the past decade due to the actions of Indigenous land defenders. Adding up the total, Indigenous resistance has stopped or delayed greenhouse gas pollution equivalent to at least one-quarter of annual U.S. and Canadian emissions

Friends of the Earth Africa: A Just Recovery Renewable Energy Plan for Africa

This report, based on the work of Dr Sven Teske from Sydney University, demonstrates how a Just Recovery plan could be achieved for USD 130bn per year and funded through public finance from the Global North, putting an end to tax dodging and dropping the debt. It also highlights the potential to create 7 million new jobs in renewable energy.

Stockholm Environment Institute: Watershed implications of shale oil and gas production in Vaca Muerta, Argentina.

This paper looks at the potential risks of shale oil and gas expansion on the region’s water supply and quality, in order to better understand the industry’s impact on the watershed and on long-term water security.

data shows that since signing the Paris Agreement, the UK Government has now spent GBP 4bn propping up the oil and gas industry

The analysis, by Paid to Pollute, also reveals this money didn’t go to oil and gas workers – 12,000 of which are estimated to have lost their jobs in 2020 – but instead went to the companies and investors. From 2015-2020, the UK Government paid just three companies – Shell, Exxon and BP – over GBP 2bn in public money to make it easier to drill for more oil and gas.

Carbon Tracker: Adapt to Survive? Why oil companies must plan for net zero and avoid stranded assets

Carbon Tracker have released their fifth annual report assessing investment risk in the oil and gas sector against the International Energy Agency’s Sustainable Development Scenario (SDS) and Net Zero by 2050 (NZE) scenarios. The report finds that under the NZE, production levels in the 2030s of the world’s largest listed oil and gas companies drops. For most companies including majors like Shell, Chevron and Eni – production falls by at least half. Most shale companies see production fall by over 80%.

Earthjustice report: Reclaiming hydrogen for a renewable future

This new report from Earthjustice’s Right to Zero campaign scrutinizes industry claims about hydrogen and delves into how to deploy it as a meaningful climate solution.

LSE and Leeds: Counting carbon or counting coal? Anchoring climate governance in fossil fuel-based accountability frameworks

In this paper, academics at the London School of Economics and Univeristy of Leeds argue for supply side governance using accountability frameworks based on a combination of fossil fuel production volumes and infrastructure.

Carbon Tracker: Flying blind: The glaring absence of climate risks in financial reporting.

Carbon Tracker analysis examines whether 107 publicly-listed carbon-intensive firms (and their auditors) considered material climate-related risks in financial reporting. At the same time the study also assesses whether investor concerns about Paris-alignment of assumptions and estimates have been addressed.

Clean Creatives: The F-List 2021: 90 Ad and PR companies working for the fossil fuel industry

This report documents the many known relationships between PR, advertising, and other creative agencies and fossil fuel companies that are responsible for climate change, and compares holding company pledges for climate action with their work for polluting clients.