THE BIG PICTURE

As COP26 fast approaches, the increasingly urgent need to phase out oil and gas production was brought into sharp focus again this month by the annual release of two major reports. First out of the gate, the International Energy Agency (IEA) published the stark conclusion that there is no room for new oil and gas projects. Crucially, the IEA solidified this finding, which it originally announced in May, by including an energy pathway aligned with 1.5°C for the first time in its flagship World Energy Outlook, a report which influences trillions of dollars of investments worldwide.

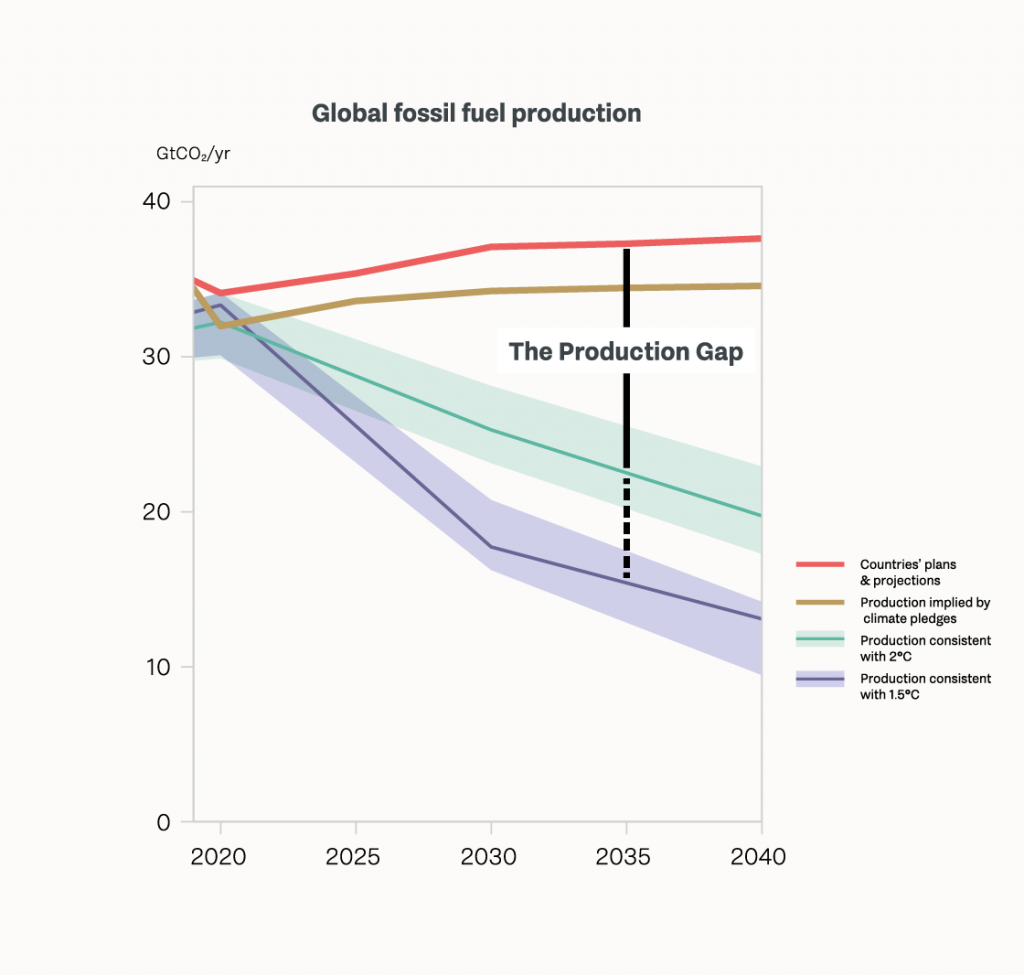

While policy makers around the world were digesting this stark message, the Production Gap Report hit them with the news that oil and gas production is continuing to head in the opposite direction. Governments around the world are planning to produce far more than is consistent with 1.5°C. With a few notable exceptions, including news from Quebec and other jurisdictions covered in this edition, little has changed since the first Production Gap Report in 2021. Raising the pressing question of whether governments and others will respond at next month’s UN climate talks in Glasgow by announcing the range of action required to tackle oil and gas production? We will bring you the answers to this along with other major developments at the COP in November’s edition of OilWire.

–The OilWire Team

THE DATA

The 2021 Production Gap Report, released this month by leading research institutes and the UN Environment Programme (UNEP), finds that despite increased climate ambitions and net-zero commitments, governments still plan to produce more than double the amount of fossil fuels in 2030 than would be consistent with limiting global warming to 1.5°C.

Governments’ production plans and projections would lead to around 57% more oil, and 71% more gas than would be consistent with limiting global warming to 1.5°C.

Source: SEI, IISD, ODI, E3G, and UNEP. (2021). The Production Gap Report 2021.

In addition to the data, the report argues:

- Global fossil fuel production must start declining immediately and steeply to be consistent with limiting long-term warming to 1.5°C.

- Verifiable and comparable information on fossil fuel production and support – from both governments and companies – is essential to addressing the production gap. Governments should strengthen transparency by disclosing their production plans in their climate commitments under the Paris Agreement.

- Governments have a primary role to play in closing the production gap and in ensuring that the transition away from fossil fuels is just and equitable. Governments can restrict fossil fuel exploration and extraction, phase out producer subsidies and public finance for fossil fuel projects, and re-direct support towards decarbonization and just transition efforts.

Lead author of the report, Ploy Achakulwisut, at the Stockholm Environment Institute (SEI) said “The research is clear: global coal, oil and gas production must start declining immediately and steeply to be consistent with limiting long-term warming to 1.5C. However, governments continue to plan for and support levels of fossil fuel production that are vastly in excess of what we can safely burn.”

WHAT WE’RE TRACKING

Trends in the Right Direction

International Energy Agency releases World Energy Outlook with new 1.5C scenario

The International Energy Agency has released the 2021 edition of its influential flagship report, the World Energy Outlook (WEO). This years’ WEO features a major change with the inclusion of a new scenario, the “Net Zero Emissions by 2050” or NZE scenario that maps out a roadmap for the energy sector that would keep global warming below 1.5°C. One of the most significant findings of the NZE is that no investment in new oil and gas would be required beyond 2021.

The IEA has stated that achieving a successful transition to 1.5°C would avoid “immense risks”, but highlights the “ambition gap” between announced national pledges and the net zero by 2050 goal. The WEO authors also point to the financial risks of over-investment, writing “actions on the supply side remain crucial to orderly and rapid energy transitions. Over investment creates the risk of underutilized, unprofitable or stranded assets, putting greater financial pressure on producing countries and companies alike. For example, most of the 200 bcm worth of LNG projects currently under construction do not recover their invested capital in the NZE, with the total stranded capital estimated at $75 billion.”

Quebec calls an end to fossil fuel extraction

The Canadian province of Quebec has announced an end to fossil fuel extraction, in a move welcomed by stakeholders and campaigners. Quebec Premier François Legault stated that the government had “decided to definitively renounce the extraction of hydrocarbons on its territory”.

Scottish First Minister says continued oil and gas extraction is “wrong”

In a major shift ahead of hosting COP26, Nicola Sturgeon, First Minister of Scotland, said “to keep exploring for and extracting oil and gas until the last possible moment…would be fundamentally wrong”. She announced in her speech that the Scottish Government will no longer support the policy of unlimited drilling for oil and gas, known as “maximising economic recovery.” Referencing the IEA’s report, Sturgeon stated that her government’s focus will be on “achieving the fastest possible just transition for the oil and gas sector – one that delivers jobs and economic benefit, ensures our energy security, and meets our climate obligations.” Friends of the Earth Scotland typified the reaction of NGOs commenting that “this welcome change of heart must be followed with a change of policy that can truly take Scotland beyond oil and gas. The First Minister and her government must now call for the Cambo oil field to be rejected and to support a ban on all new oil and gas projects.”

Brazil offshore license auction failure

Brazil has just had its worst result in an oil and gas auction since they began in 1999. The Government sold only five of the 92 areas for exploration and production. The blocks were located in new frontier areas beyond established oil and gas regions in Brazil and near sensitive maritime reserves. Many NGOs questioned the necessity of the auction and worked to raise public awareness, calling for it to be cancelled, on the grounds that exploration in these areas would pose major environmental and social risks. Though it went ahead, the issues were heavily publicised and the round failed to attract interest from bidders. Of the five block rights acquired, four were by Shell and one by a Shell/Ecopetrol consortium. It was the lowest bid in the history of Brazilian oil and gas rounds, at a price of just BRL 37 million ($6.7 million).

EU seeks ban on exploration in the Arctic

Legislative proposals released under the new European Green Deal include a number of measures aimed at reducing fossil fuel extraction, including an EU Arctic Strategy which states “the EU is pushing for oil, coal and gas to stay in the ground, including in Arctic regions.” As part of the strategy, the EU will seek a ban on fossil fuel exploration in the Arctic and will aim to end imports of any oil or gas produced in the environmentally sensitive region.

Banque Postale will cease services to oil and gas sector by 2030

French public bank La Banque Postale has announced it will end finance for fossil fuel projects and stop providing financial services to the oil and gas sector after 2030. It will also gradually divest its existing holdings. The announcement comes in the wake of the IEA’s findings that renewable energy investment must triple over the next decade. Environmental organisations Reclaim Finance, Friends of the Earth France and Oxfam France said they welcomed Banque Postale’s move. If all banks were to copy and paste La Banque Postale’s policy, the climate would be largely spared,” they said in a joint statement.

Pension fund ABP to divest oil and gas companies.

ABP, the Netherlands’ largest pension fund and 5th largest in the world, with assets under management of $575bn is reported to have made the decision to divest for a number of reasons: First, the ethical desire of members to contribute to limiting global warming to 1.5 degrees. Second, because they saw “insufficient opportunity for us as a shareholder to push for the necessary significant acceleration of the energy transition at these companies”. And third, because they were facing the threat of legal action in the Netherlands over its fossil fuel investments. ABP board chairman Corien Wortmann said they will focus their energy transition engagement efforts on large users of fossil energy such as electricity companies, the car industry, and aviation. The fund said it did not expect the decision to affect its long-term returns. The announcement came the same day it was announced that 1485 institutions worth $39.2 trillion have made divestment pledges.

Israel to stop permits for oil exploration

Israel has announced new measures on climate change, including a halt to new permits for conventional onshore oil exploration. The Energy Ministry later clarified this only covered terrestrial crude oil and not shale oil. At present, there are five licenses for terrestrial oil production and three permits for exploration.

UK announces suite of climate measures ahead of COP26

UK Prime Minister Boris Johnson announced plans to eliminate fossil fuels from electricity generation, stating that as well as climate benefits, a decarbonised grid would be protected from gas price fluctuations of the type that the UK is currently facing. The UK currently generates 43% of its electricity from renewable sources and around one third from gas. The government also signalled an ambition to phase out gas boilers by 2035. In the same week, the government revealed that it will introduce mandatory financial and corporate sustainability reporting requirements which will include the disclosure of net zero transition plans. It also set out details of a UK Green Taxonomy that will be used to identify sustainable activities. Reaction to the announcements was mixed, with many praising the policy ambition while expressing disappointment at the lack of financial support from the Treasury needed to achieve the scale of transformation required.

California Moves to Prevent New Oil Drilling Near Communities

Governor Newsom announced that California’s oil regulator has released its draft health and safety rule recommending a mandated 3,200-foot distance between new oil and gas extraction sites and the places where people live, work and play. According to the Associated Press: the 32,400 wells within 3,200 feet of community sites account for about a third of the state’s oil extraction. The news was welcomed as a victory for frontline communities who have been campaigning for years to protect public health. Many groups are calling for Newsom to go further, halt all permits for new projects and invest in a just transition to phase out existing drilling. They argue that given the climate risk and broader health impacts of fossil fuel combustion, there is no safe distance at which oil and gas drilling is acceptable.

Campaign News

Complaint filed against the World Bank over East African Crude Oil Pipeline

Members of the #StopEACOP Alliance have supported communities directly affected by the East African Crude Oil Pipeline and associated projects to file a groundbreaking complaint to the Compliance Advisor Ombudsman – an independent complaints mechanism attached to the World Bank Group. The complaint, filed during the World Bank’s annual meeting week, details how the bank is indirectly exposed to the oil projects through its investment in an East African firm that is providing insurance for the projects. The complaint doesn’t only focus on the World Bank’s role, though. It highlights another crucial type of financial backer for the pipeline: insurance companies.

Calls grow to protect Verde Island Passage from gas projects

Community stakeholders, civil society organizations and faith groups in the Philippines have pressed Linseed Field Power Corporation and SMC Global Power Corp. to withdraw their funding of the fossil gas and LNG projects in the area. The groups have raised their concerns and opposition to the expansion of liquefied natural gas (LNG) terminals in Batangas, which are seen to cause detrimental and irreversible effects to the Verde Island Passage and the local communities that are dependent on it. The passage is home to more than 1,736 fish species within a 10-kilometer area, including 60% of all known shorefish, as well as 338 coral species, and thousands of others.

Scientists call on governments to adopt a Fossil Fuel Non-Proliferation Treaty

An academic letter signed by over 2,100 scientists calls on governments around the world to adopt and implement a Fossil Fuel Non-Proliferation Treaty. It includes the likes of Michael E Mann, Katharine Hayhoe and David Suzuki.

US Judge overturns lease decision in Colorado

Following a lawsuit filed by US-based conservation groups, a US federal judge has overturned a 2018 US Bureau of Land Management (BLM) decision to lease 58,000 acres of land in Colorado for oil and gas exploration. The case found that BLM had failed to undertake the correct land and health risk assessments ahead of the decision, and that exploration on the land would worsen air quality and pose a threat to public health.

Oil Majors’ CEOs will testify in US congress on climate misinformation

CEOs of four of the largest oil companies globally, Exxon, Chevron, Shell, and BP, will appear in front of the US congress at the end of October to provide testimony on climate misinformation. Congress has called it a “long-running, industry-wide campaign to spread disinformation about the role of fossil fuels in causing global warming”. Commentators are drawing parallels with Congressional hearings which led to landmark lawsuits against Big Tobacco in the early 90s.

EU in breach of its own climate laws if gas is included in sustainable finance taxonomy

The European Commission is in the final stages of preparing the climate portion of its sustainable finance taxonomy, designed to create harmonised definitions of ‘green’ activities across Europe. Activities defined as ‘green’ will be able to access additional support, and in some cases concessional capital. One of the most controversial issues pervading the development of the taxonomy has been the question of whether to include fossil gas. Civil society groups have urged the European Commission to exclude gas, as they fear it will delay or derail the energy transition. Earlier this month, environmental law group Client Earth warned the EU that it would be in breach of its own laws if it includes gas in the taxonomy, notably its legally binding target to reduce emissions by 55% by 2030.

Bank of England governor faces calls to green UK finance

Eighty five parliamentarians have sent an open letter to Bank of England governor Andrew Bailey urging him to align UK finance with the national climate goals. Citing guidance from the International Energy Agency that investment in new fossil fuel supply must end this year, the letter sets out a series of recommendations for greener finance.

Climate scientists push UK to cease new oil and gas investment

As the UK prepares to host COP26, and British Prime Minister Boris Johnson calls on world leaders to “grow up” and “recognise the scale of the challenge we face”, the UK government has come under fire for failing to take adequate measures to limit fossil fuel production. A letter from 70 scientists urges Johnson to commit to ending oil exploration in the North Sea, and in particular to shut down the controversial Cambo project off Shetland, which commentators say is in direct contradiction with the UK’s own climate commitments.

Petition for ambitious report on climate-related financial risk in the US

Earlier this year President Joe Biden signed an Executive Order on Climate-Related Financial Risk. As part of the process, US Treasury Secretary Janet Yellen was invited to produce a report considering how climate related financial risk can be mitigated. Ahead of its release, a petition with 40,000 signatures was delivered to Yellen, urging that the report consider the gravity of the threats climate change poses. Detailed expectations for the report were set out in a briefing note by Public Citizen and Americans for Financial Reform. The report is expected to be released this week.

More headlines

Latin America and the Caribbean face fossil fuel supply challenges

A new report for the Inter-American Development Bank reveals the pressures facing oil and gas producers in Latin America and the Caribbean. One the one hand, the report shows, fossil fuel revenues are an important source of income for many countries in Latin America and the Caribbean and as oil prices continue to rise, many countries are looking to expand exploration. On the other hand, “committed emissions” (emissions associated with existing and planned fossil fuel infrastructure) would exceed the regional carbon limit by 150% and up to 80% of proven fossil fuel reserves in the region must remain in the ground. In a blog post on the report, the authors argue early action, particularly providing workers and communities with support, will help to steward an orderly and just transition and avoid wasted capital on stranded assets.

Research finds that hydrogen may be a potent “indirect” contributor to global warming

There has been an increasing focus on hydrogen in recent years as a key component of zero carbon transition strategies. In its recently released strategy on hydrogen, the European Commission stated that hydrogen could meet 24% of global energy demand by 2050. Recent research has suggested, however, that it may have negative effects on the climate. Hydrogen can interact with methane in the atmosphere, extending its life and amplifying its warming effects. The effects are under researched and poorly understood, but these findings suggest that an over-reliance on hydrogen may be creating unforeseen risks.

Oil and gas producers barred from formal COP26 role

The COP26 organisers have confirmed there is no formal role for oil and gas companies at the event. The UK’s Climate Champion stated current commitments from oil firms were insufficient and that “It’s imperative that the Glasgow meeting calls for the highest levels of ambition in terms of immediate emissions reduction…It [Cop26] cannot offer a platform to entities that do not meet this level of commitment.”

President Biden’s “middle-of-the-road” strategy on fossil fuel supply is inconsistent with “code red” for humanity

Derrick Jackson from the Union of Concerned Scientists argues that this summer’s IPCC report which the UN Secretary General described as “Code red for humanity” has to translate into a red light on fossil fuels. Biden’s high-profile decisions on fossil fuel supply, including the cancellation of Keystone XL, and the Arctic refuge drilling moratorium are deemed to be undercut by the federal government’s continued approval of thousands of new drilling permits on public and tribal lands, and support for record setting rates of fracking in Appalachia.

Banks under fire for loopholes in Arctic drilling policies

A number of the largest global banks, including Goldman Sachs, HSBC, and BNP, have set exclusions on financing drilling for fossil fuels in the Arctic in recent years. These policies have come under fire from investors and stakeholders, however, for containing loopholes that have enabled the expansion of drilling in the environmentally sensitive region. Critics say that a key limitation of the banks’ policies are that they often only exclude project finance, while continuing to provide corporate finance for companies active in the area. 90% of energy investments are financed through balance sheets where project finance restrictions would not represent a significant constraint. The banks are also facing criticism for setting narrow definitions of the geographic area of the Arctic that enables them to continue exploration. BNP and HSBC have stated they will review their pledges.

New Norwegian government plans fossil fuel expansion

Norway’s recently formed centre-left coalition government has stated that they plan to continue expanding fossil fuel production into the future. Campaigners and commentators say that these plans are incongruous with Norway’s national pledge to cut emissions by 55% by 2030. Norway is Western Europe’s largest oil and gas producer. Climate activists continue to call on the country to announce an end production.

Al Gore urges overhaul of global finance to cut greenhouse gases

In an interview with the FT, Gore called for increased regulation and disclosure to force banks, traditional asset managers, private equity firms and other asset owners to overhaul how they deal with climate change risks. Gore argued that banks’ regulatory capital requirements should be changed to incorporate climate change and that global accounting standards need to be reformed to put sustainability accounting and financial accounting into one broader framework. He also emphasized the importance of mandatory disclosure covering private equity: “When large asset managers offload assets [because of climate concerns], it underscores the need for mandatory disclosure in private equity so that those same assets don’t continue to operate under new owners in the shadows.” Additionally, Gore highlighted the problem of offsets, arguing that “It is suicidal for the human race to continue on this track and to pretend that it can be somehow negated by promising to plant trees here, there or elsewhere. This is simply not realistic.”

Oil workers are critical to a just energy transition

Two opinion pieces in the last few weeks highlight that many workers support the energy transition and have a crucial role to play in bringing it about. Petroleum engineer, Erik Dalhuijsen, argues that while many people in the oil industry – including those who work offshore – have skills that can be transferred into the renewable energy sector, the industry leaders are refusing to adapt. Anna Markova, the Trades Union Congress’s co-lead on climate and industrial policy, highlights four key components to a just transition: government resources, giving workers a say over how the transition happens, removal of barriers to switching sectors, and an emphasis on high quality jobs.

Industry News

Nigeria plans major fossil fuel expansion

Under a new law, the Petroleum Industry Act, the Nigerian government is planning to increase its oil production by 310% to 4 million barrels per day. The act also aims to facilitate the expansion of the country’s fossil gas reserves. Timipre Sylva, Minister of State for Petroleum Resources, has stated “we have declared that gas is our transition fuel”.

Tension in US over how to address abandoned oil and gas infrastructure

Old and abandoned oil and gas infrastructure in the US is creating a host of environmental and climate problems which will only worsen as extreme weather events become more common. California recently faced one of its biggest off-shore oil spills in almost 30 years. Earlier in the year, a decommissioned pipeline, damaged during Hurricane Ida, created a large oil spill off the coast of Louisiana. There is also increasing awareness of the risks of methane leakage from old natural gas wells. 32,000 wells drilled in federal waters (59%) have been abandoned. In response, many are calling for stricter regulations in order to prevent future spills and protect taxpayers from costs associated with clean up and decommissioning.

However, others are seeing an investment opportunity. Diversified Energy, based in the Appalachian region, has bought up 69,000 old and abandoned wells, recently eclipsing Exxon Mobil as the largest owner of oil wells in the US. Diversified’s business strategy relies on continuing to extract oil and gas from old wells for an average of 50 additional years, discounting clean up and decommissioning costs into the future so that they become negligible. This has raised concerns on a number of fronts, but particularly on methane leakage, misalignment with plans for the zero carbon transition, and whether Diversified will be able to cover the decommissioning costs, especially if they occur earlier than planned.

Australian banks face calls from shareholders to end fossil fuel finance

A group of around 100 shareholders has filed climate-focused resolutions at three of Australia’s four largest banks: Westpac Banking Corp (WBC), Australia and New Zealand (ANZ) Banking Group and National Australia Bank (NAB). The resolutions, filed in the run up to COP26, call on the banks to halt their fossil fuel financing in line with climate goals. Support for similar resolutions at NAB and ANZ doubled last year. Australia is the world’s largest exporter of coal and has one of the highest carbon emissions per capita globally.

Bolsonaro considers privatising Petrobras

Brazilian President Jair Bolsonaro is considering selling off the government’s majority stake in oil company Petrobras in the wake of rising fuel prices. Bolsonaro is facing increasing criticism as gas price hikes have driven consumer inflation into double digits. The president is considering his options ahead of Brazilian presidential elections that will be held next year.

RESOURCES

The Sky’s Limit Africa: The Case for a Just Energy Transition from Fossil Fuel Production in Africa

Oil Change International’s report assesses fossil fuel industry plans to sink $230 billion into the development of new extraction projects in Africa in the next decade — and $1.4 trillion by 2050. It finds these projects are not compatible with a safe climate future and that they are at risk of becoming stranded assets that leave behind unfunded clean-up, shortfalls of government revenue, and overnight job losses.

Earthrights International: Frontlines of Climate Justice: Defending Community Resistance to Climate Destruction

The Frontlines of Climate Justice campaign builds on the work of local communities and defenders around the world working on demanding profound change. The campaign will amplify their voices and expose the tactics used by extractive and agribusiness companies to violate communities’ rights. The goal of the campaign is to ensure that policymakers recognize the central role that frontline communities must play in the global response to the climate crisis and to defend the rights of frontline communities to speak up without fear of reprisals.

E3G and the Stanley Centre: Las cuatro D para la transición justa del petróleo: Deuda, divulgación, demanda y disminución planificada de la producción

This Spanish-language report from E3G and the Stanley Centre for Peace and Security sets out the ‘four Ds’ of a just transition away from fossil fuels: debt, disclosure, demand, and decreasing production.

Carbon Tracker: Race to the Top: Internalising Oil and Gas Retirement Costs

To address the growing orphan well crisis, state and federal regulators in the US must take steps to ensure that solvent operators fulfill their existing obligations to pay for this plugging and reclamation liability before they too become insolvent. This report offers two related tools for assessing the effectiveness of state regulatory reforms at shifting well retirement costs from taxpayers to the legally responsible parties in industry.

Global Witness: President Biden is set to choke the world’s climate in fossil gas

New analysis from Global Witness found the US is on track to become the world’s top LNG exporter by 2023, on Biden’s watch. Not only that, but the US is set to pump out an extraordinarily destructive amount of new gas over the next decade: nearly five times as much new gas as the next largest producing country, Canada, and more than all other countries combined. Needless to say, this would lead to major climate damage and help to push the world beyond its climate goals, all on Biden’s watch.

Parliamentary Briefing: the green taxonomy and how to tackle greenwashing

The UK’s all-party parliamentary group (APPG) on sustainable finance has released a briefing note addressing the twin issues of greenwashing and the green taxonomy. The briefing includes recommendations from the APPG’s expert advisors GFI and E3G.

Report: Permian Climate Bomb

A new report published by Center for International Environmental Law, Oil Change International, Earthworks and, tracks the Permian Basin’s oil and gas development, impacts, and possible futures. Oil and gas production in the Permian Basin (parts of Texas and New Mexico) has grown significantly in the past decade and is still expected to grow a further 50% by 2030. This report explores the climate impact of the Permian boom, the public health, environmental, economic, and social impacts of fracking, the Permian Basin’s link to environmental injustice and petrochemical expansion on the Gulf Coast, and the flow of Permian hydrocarbons to export markets. The report is online in English and Spanish.

FracTracker Alliance: Two pieces on Environmental Justice

FracTracker reports that California prisoners are on the frontlines of the environmental justice movement, as thousands are living within 2,500 feet of operational oil and gas wells in industrially zoned areas. Additionally, the group reveals oil and gas wells in Los Angeles disproportionately impact marginalized communities, producing dangerous levels of invisible, toxic emissions.

Report: Stop the revolving door

New research by Fossil Free Politics members Corporate Europe Observatory, Friends of the Earth Europe and Food & Water Action Europe explores 71 revolving door cases involving the public sector (national governments and agencies, the EU, and international institutions) and six Big Energy firms and five of their lobby groups between and 2021.

Global Energy Monitor: Asia’s Gas Lock-in

A new report by Global Energy Monitor (GEM) argues that a planned $379 billion investment into the expansion of gas infrastructure in Asia risks creating stranded assets and undermining pledges by several Asian countries to achieve net zero emissions as part of a transition to renewables by mid-century.